Power of Corporate Actions that Impacts Share Price

INTRODUCTION

Corporate actions play an essential role in shaping the financial landscape, particularly in reference to the stock markets. These actions, taken by companies, can have a significant impact on share prices, influencing the value and perception of a company among investors. Understanding how corporate actions work and their potential consequences is essential for investors to make informed decisions or adjustments to their current portfolios. In this article, we will explore the power of corporate actions and their impact on share prices.

Corporate actions encompass a broad range of actions initiated by companies that affect their shareholders. These actions are often designed to either enhance shareholder value or address specific company objectives. By executing corporate actions, companies can redistribute capital, adjust their capital structure, or change ownership structures.

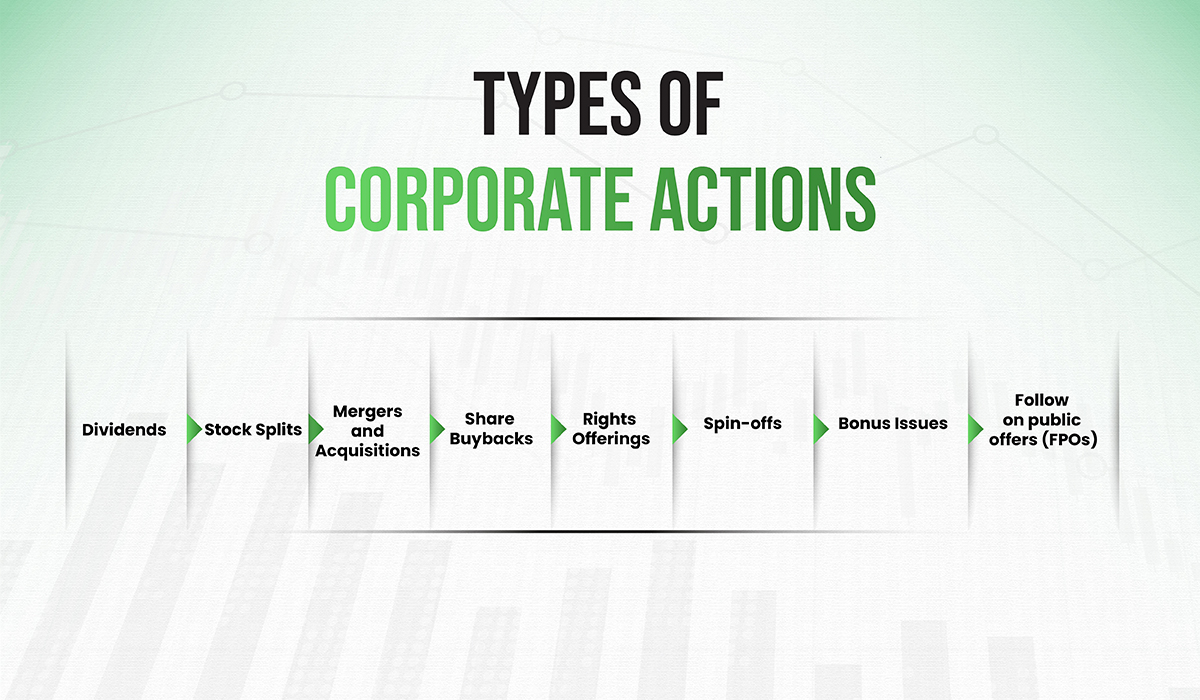

TYPES OF CORPORATE ACTIONS

There are various types of corporate actions, each with its own implications for share prices. Let’s examine some of the most common ones:

1. Dividends:

Dividends are one of the most well-known corporate actions. The share price of a company can be significantly impacted when a portion of its profits is distributed as dividends to shareholders. Companies with a history of consistent and increasing dividends often attract income-seeking investors, which can drive up the share price.

2. Stock splits:

Stock splits involve dividing existing shares into multiple shares, effectively increasing the number of outstanding shares. While the total market value remains the same, the share price decreases proportionately. Stock splits are often seen as positive signals, making the shares more affordable and potentially attracting a broader investor base.

3. Mergers and Acquisitions:

The merger or acquisition of two or more businesses is known as M&A. Share prices can fluctuate significantly when an M&A deal is announced. Depending upon the conditions of the agreement, the acquiring company’s share price might rise or fall respectively, reflecting market sentiment and expectations regarding the potential benefits or risks associated with the merger.

4. Share buybacks:

Share buybacks occur when a company repurchases its own shares from the market. This action reduces the number of outstanding shares, leading to an increase in earnings per share and often signaling that the company believes its stock is undervalued. Share buybacks can result in higher share prices due to improved investor confidence.

5. Right issue:

Rights issue allow existing shareholders to purchase additional shares at a discounted price. While this action can dilute existing shareholders’ ownership, it provides an opportunity for them to increase their stake in the company. The announcement of rights offerings can initially lead to a decline in share prices, reflecting the dilution effect.

6. Spin-offs:

Spin-offs involve a company separating a subsidiary or division into an independent entity. This action can unlock value by allowing the market to value the separated entity separately. Depending on the perceived potential of the spin-off, the share price of both the parent company and the newly formed entity can experience fluctuations.

7. Bonus issue:

Bonus issues, also known as scrip dividends or capitalization issues, involve issuing additional shares to existing shareholders as a bonus. This action is often implemented when a company wants to reward shareholders without utilizing cash resources. Bonus issues can lead to a temporary decrease in share price due to the increased number of outstanding shares.

8. Follow on public offer (FPO):

A procedure known as an FPO (Follow on Public Offer) is one in which a company that is already listed on an exchange issues new shares to existing shareholders or investors, typically the promoters. FPO is utilized by organizations to broaden their equity base. After going through the IPO process and deciding to make additional shares available to the public or to raise capital for expansion or debt repayment, a business uses FPO.

IMPACT OF CORPORATE ACTIONS ON SHARE PRICE

Corporate actions can have various impacts on share prices, depending on the nature of the action and market conditions. Let’s explore some common effects:

Positive impact: Certain corporate actions, such as dividend increases, stock splits, and share buybacks, often result in a positive impact on share prices. These actions signal confidence in the company’s financial health, growth prospects, or the ability to distribute returns to shareholders.

Negative impact: On the other hand, corporate actions like rights offerings and dilutive acquisitions can initially lead to a negative impact on share prices. These actions may dilute existing shareholders’ ownership or indicate financial challenges or risky growth strategies.

Temporary impact: Some corporate actions, such as bonus issues and spin-offs, can cause temporary fluctuations in share prices. The market often adjusts to reflect the new share structure and assess the long-term value potential of the separated entities.

IMPORTANCE OF UNDERSTANDING CORPORATE ACTIONS

For investors, understanding corporate actions is vital for making informed investment decisions or adjustments in a current portfolio. By comprehending the potential impact of these actions on share prices, investors can position themselves advantageously. Additionally, knowledge of corporate actions allows investors to assess the underlying financial health and strategic direction of a company.

CONCLUSION

corporate actions wield considerable power in shaping share prices. Dividends, stock splits, mergers and acquisitions, share buybacks, and other actions can trigger significant reactions from the market. By understanding these actions and their implications, investors can navigate the complexities of the stock trading more effectively and potentially capitalize on opportunities that arise.

FAQs

1. How do dividends affect share prices?

Dividends can positively impact share prices, especially when companies consistently increase their payouts, attracting income-seeking investors.

2. Do all corporate actions lead to a permanent change in share prices?

No, some corporate actions may cause temporary fluctuations in share prices as the market adjusts to the new circumstances.

3. What factors should investors consider when evaluating the impact of corporate actions?

Investors should consider market conditions, company performance, and investor sentiment when assessing the potential impact of corporate actions.

4. Are all corporate actions beneficial for shareholders?

Not necessarily. Some actions, such as dilutive acquisitions or rights offerings, can have a negative impact on existing shareholders.

5. Why is it important for investors to understand corporate actions?

Understanding corporate actions enables investors to make informed decisions, evaluate a company’s financial health, and potentially capitalize on market opportunities.