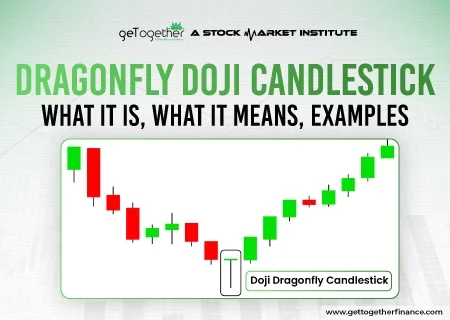

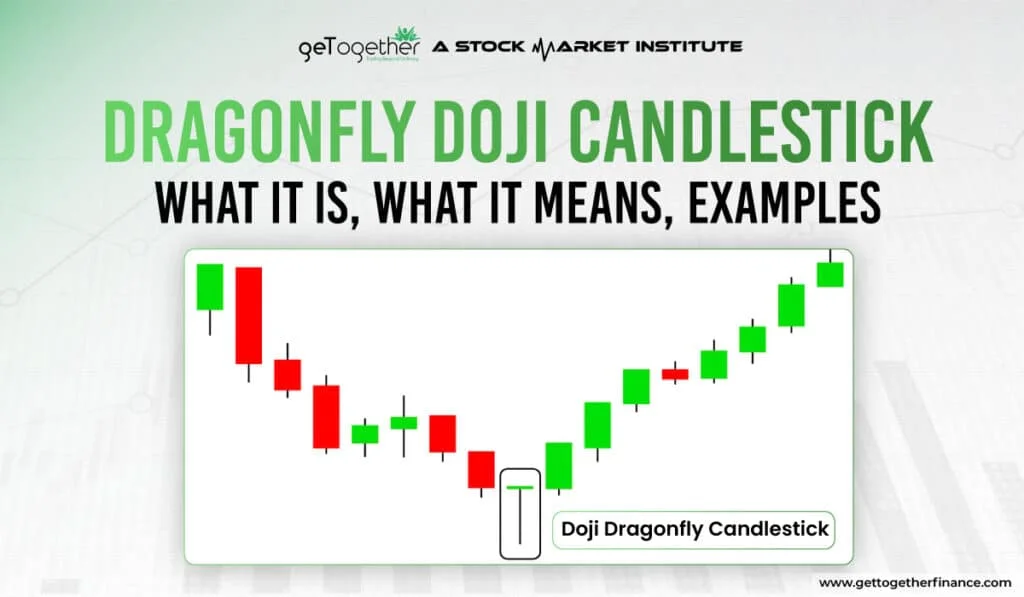

Dragonfly Doji Candlestick: What It Is, What It Means, Examples

- May 17, 2025

- 2391 Views

- by Manaswi Agarwal

Doji Dragonfly is a candlestick pattern that signals a potential reversal in the price movement which is either downside or upside, it depends on the past price movements. You must have known that a doji candlestick represents the fight between buyers and sellers in the market.

Table of Contents

ToggleWhat is the Dragonfly Doji Candlestick Pattern?

Dragonfly Doji is a candle that has no real body and a long downward shadow. The long lower shadow in the dragonfly doji indicates some assertive selling during the timeframe, however, buyers enter to absorb the selling pressure and push the price back up.

The open, close and high of the asset are at the same level in dragonfly doji candlestick while the low price is much lower hence giving a long lower shadow in the candlestick.

Characteristics of a Dragonfly Doji Candlestick

The extended lower shadow in the doji candlestick is the most crucial aspect of this pattern with some of the main characteristics listed below:

- No real body with shadows.

- Opening and closing prices are almost the same.

- A T-shaped candlestick when the open, high, and closing prices are almost the same.

Interpretation of Dragonfly Doji Candlestick

The formation of the dragonfly doji candlestick on the charts clearly indicates a price reversal in security.

The pattern with a long lower tail suggests an enormous amount of selling in the market due to which the prices experienced a great downfall. However, at the end of the session buyers absorbed the selling pressure and pushed the prices upwards.

The dragonfly pattern is considered bullish when the prices of the security have been trending lower which signals an impending price hike. If the following candles continue to close at higher prices, it confirms the bullish signal in the security, hence allowing traders to make easy trading decisions.

Trading with Dragonfly Doji Candlestick

In technical analysis, candlestick patterns determine the sentiments of buyers and sellers. Here are the points that must be followed to trade through dragonfly doji candlestick.

- Look for the downtrend in the security as the pattern becomes more significant when it follows a particular trend.

- Determine the long lower shadow which indicates the fall in prices during the day but the buyer’s gaining dominance at the end of the session by pushing the prices higher.

- The candle should have no upper shadow which implies the inability of the price to advance higher during the day with a significant resistance level at the high of the day.

- Traders look at the confirmation with the following bullish candles formed after the dragonfly doji candlestick. The stronger the rally, the more reliable the reversal becomes.

- It allows them to make long positions and place orders immediately after the occurrence of the confirmation candlestick.

Limitations of Dragonfly Doji Candlestick

Dragonfly Doji Candlestick also has its limitations as it is uncertain if it would be able to give the trend reversal.

Less Reliability

The prominent intricacies of the stock market never assure the future price action of the security. The pattern is not a very reliable technical indicator of price reversals as it goes with the confirmation.

Dependence on Technical Indicators

The efficiency of the pattern depends on several technical indicators as well as the volume. Apart from this, in this pattern, traders are unable to identify price targets that do not provide clear directions to continue or exit the trade.

Using the Demand and Supply Approach

To trade with dragonfly doji candlesticks with more reliability, traders can make the use of the demand and supply approach.

If the formation of dragonfly doji candlestick is observed coinciding with the demand or supply zones, the reliability of the pattern increases. If you find the candlestick formation in the demand zones, you can go for the long position depending on the increase in volume.

Dragonfly Doji Pattern vs. Gravestone Doji Pattern

Both the patterns are quite similar and are the representation of trend reversal in security. However, in gravestone doji candlestick patterns, low, open, and close prices are the same with a long upper shadow. The gravestone doji looks like an upside-down “T”.

On the other hand, while considering the dragonfly doji candlestick pattern, occurs when the open, high, and close prices are the same with a long lower shadow. It looks like the alphabet “T” depicts a possible trend reversal with the following candles.

FAQs

What does dragonfly doji indicate?

Dragonfly Doji Candlestick pattern demonstrates a potential fight between buyers and sellers where the open, high, and close prices are almost the same in the pattern. It confirms a potential reversal in the trend with the formation of the following candles.

What is the difference between a dragonfly doji candlestick and a hammer candlestick?

In the hammer candlestick pattern, the open, high, and close prices are not identical, while in the dragonfly doji pattern, the open, high, and close prices are almost the same.

How is a Dragonfly Doji formed?

The pattern forms when opening and closing prices are nearly the same and the price creates a long lower shadow and little to no upper shadow.

How do I trade using the Dragonfly Doji?

Enter a long position after the downtrend and vice versa to enter the short position.

Can the Dragonfly Doji appear in any market?

Yes, the Dragonfly Doji can appear in any market, including stocks, forex, commodities, and cryptocurrencies.

Does Doji Dragonfly appear significantly?

Dragonfly Dojis are not very rare but are more significant but require correct interpretation with confirmation.

Instagram

Instagram