Rising Three Methods: What It Is and How It Works

- Updated on : December 5, 2025

- 2322 Views

- by Manaswi Agarwal

In the technical analytical realm of financial markets, there are various patterns that guide the future momentum in security based on the candlesticks. The rising three method pattern is a bullish pattern which signifies an increased buying pressure in the security. It is a continuation pattern that appears in an uptrend which needs to be understood with its components, pros and cons and this blog can make you aware about the rising three methods.

Table of Contents

ToggleWhat is the Rising Three Method Pattern?

The Rising Three Method pattern in technical chart analysis is the form of Japanese candlestick pattern which represents the bullish continuation pattern. In financial markets, technical analysis offers valuable insight to traders and in this analytical realm, the rising three methods pattern witnesses a rise in the share prices. The pattern occurs during an uptrend while confirming a bullish trend for traders.

Components of Rising Three Method Pattern

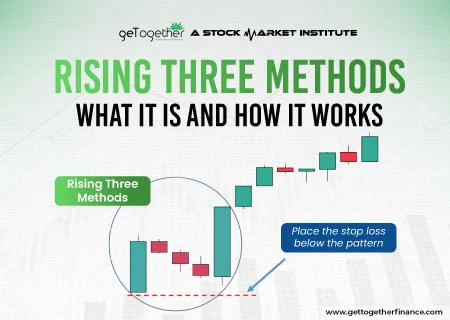

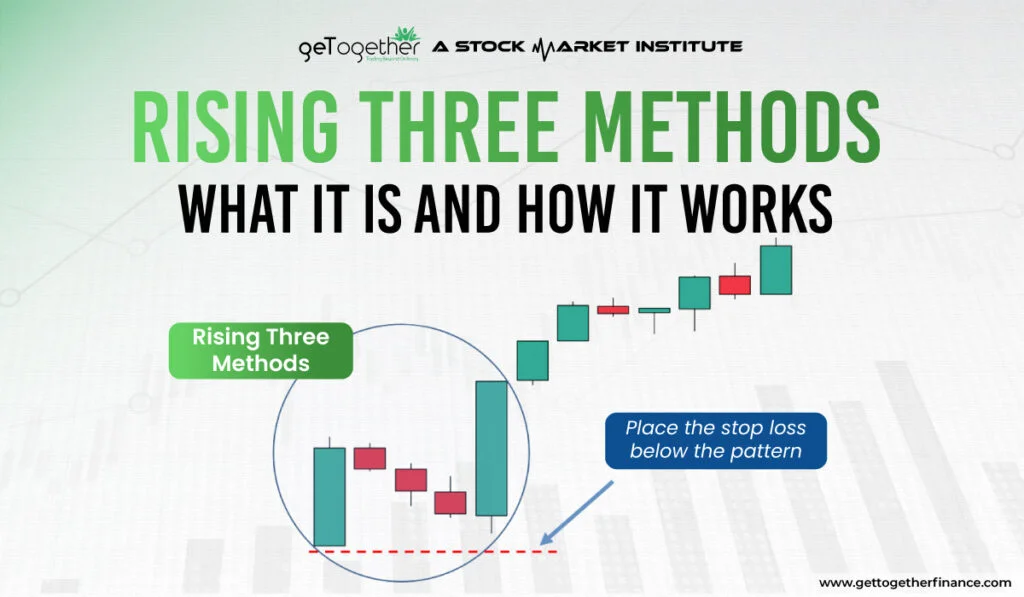

For the recognition of the rising three method pattern, there are several components which help you to understand the formation of the pattern. The components of rising three method pattern are categorized into three different phases consisting of five candlesticks:

First Phase

The first candlestick in the rising three patterns is a robust, long bullish candle that marks the uptrend in the security showing dominance of buyers. The formation of long candles with its strength initiates underlying bullish sentiment in the security.

Second Phase

The second phase of the formation is constructed by three bearish candlesticks. After the initiation of a strong bullish candle, three smaller bearish candles form in a sequence to signify the temporary influx of sellers which is a form of correction. The size and strength of these bearish candles is crucial to understand the relation with the previous bullish candle. The correction phase marks the continuation of uptrend in the security controlling overall dynamics of the price.

Third Phase

The rising three candle pattern sums up with the formation of a long bullish third candle that surpasses the first candle’s high. This candle confirms the domination of buyers and completion of this sequence represents the persisting bullish trend.

What does the Rising Three Method Pattern indicate?

To accurately identify the rising three methods pattern, traders must closely observe the formation of candlesticks on the chart patterns. It is essential to pay attention to the correction phase to ensure that the price remains in reasonable bounds without compromising the bullish trend.

The psychology behind the rising three patterns determines the positive outlook of investors towards the security with increased interest of buyers where the uptrend is continued. However, bears take a temporary control over the security from the bulls and pull the price downwards from current levels for correction. A negative sentiment in the security drives in after the strong bullish candle that doesn’t lead the bulls to make new highs.

This correction is represented by three short red candles as the buying volume becomes lower compared to the selling volume and hence pushes the prices downwards. While the bulls regain their control at the last day because of the inability of sellers to sustain in the market. Therefore, buying pressure is increased with volume leading to the formation of green bullish candles and continuation of the bullish trend.

Trading Strategy with Rising Three Method Pattern

In the rising three method pattern, the entry point is marked after the formation of the third phase as it confirms a bullish momentum in the security. The candle ensures a continued uptrend in the security where traders can place their entry when the price surpasses the previous high. To gain enough profitability from ongoing uptrend, the entry must not lie near the resistance level or the supply zone.

Trading rising three methods is considered viable when the high and low wick of the previous bullish candlestick are shallow. It might prove to be effective considering the long term time frames.

At the same time, ensuring risk management is essential to avoid losses which requires to place stop loss orders below the low of the final bar as per your risk tolerance.

Demand and Supply: On the other hand, demand and supply is one of the best measures that guides you efficiently about risk management. Trading rising three method patterns under the influence of demand and supply theory can ensure profits as it is comparatively more reliable than trading solely on technical indicators.

Traders enter the long position when price comes into the demand zone after the completion of the last phase. The demand zone pushes the prices upwards as it executes the pending orders placed by institutions. When rising three method pattern forms, enter the long position if it coincides with the demand zone to increase the reliability.

Pros of Rising Three Method Pattern

Traders gain a lot of profitable opportunities as identifying rising three method patterns on the charts is quite easy and can be traded successfully when associated with other technical indicators.

Defined Bullish Signal

Many traders consider rising three method patterns to confirm the bullish signal as it is a strong indicator to identify increased buying momentum in the security. The distinct sequence of candles, being the bullish one at the start and the end, in between the correction phase, visually indicates potential bullish continuation helping traders to make informed decisions.

Versatile Concept

The rising three method pattern is one versatile concept that is applicable to different markets like stocks, forex, cryptocurrencies, commodities, etc.

Cons of Rising Three Method Pattern

Apart from the benefits involved in the rising three method patterns, certain limitations obstruct the path for traders. The limitation can be:

Market Sensitivity

During volatile conditions in the market, the rising three method pattern might in fact produce less reliable signals. Volatile conditions give a rise to unpredictability in the market that impacts the pattern’s ability to remain bullish against market sentiments.

False Signals

Trading on technical chart patterns like rising three methods is subject to providing false signals which reduce the pattern’s ability to offer reliability and accuracy.

Refined Analysis

To trade with rising three method patterns involves incorporation of various technical indicators to receive the confirmation of continued bullish pressure in the security. If any one of these indicators does not work successfully, the trade can result in losses for the traders.

Conclusion

A rising three method pattern suggests a continued bullish momentum in the security. Traders make long positions considering the bullish outlook of the security with a focus on other technical factors like volume, etc. However, when you trade the rising three method, it is highly preferable to associate it with demand and supply theory to get the best results.

FAQs

What is the Rising Three Method Pattern?

The rising three method pattern is an indication of bullish continuation in the security. The formation of distinct candlesticks with a period of short correction signifies strong buying pressure at the end of the formation.

How to identify the rising three method pattern?

To identify the rising three method pattern, the first and the last candle indicates the buying pressure in the security where the three candles in the middle form a correction phase as the prices move downwards.

Is trading on the Rising Three Method Pattern successful?

Trading on rising three method patterns involves various market risks, economic risks and hence it is not always preferable as market support is essentially required.

Can I trade solely based on the rising three method pattern?

Trading solely based on the rising three method pattern is somewhat risky and can move in a negative direction.

Instagram

Instagram