Top Trading Platforms with Built-in Strategy Builders

When trading options, using the right platform can make a big difference. It helps you plan, place, and adjust your strategies more easily. With built-in strategy builders, users can set trades aligned with their comfort level and market expectations. Dhan’s Options Trader is introducing important advancements in this area. Let’s examine leading trading platforms and understand how they support options traders in making informed decisions.

Table of Contents

ToggleKey Traits to Look for in Platforms with Built-In Strategy Builders

Below are some essential features to consider when evaluating such platforms:

| Feature | Description |

| Intuitive Interface | A user-friendly layout that is easy to navigate, suitable for both new and experienced traders. |

| Multi-leg Order Support | The ability to create and place strategies involving multiple option legs in a single order. |

| Risk Management Tools | Integrated tools such as stop-loss, OCO (One Cancels the Other), and trailing stop features help manage risk effectively. |

| Strategy Testing | Functionality to test strategies using real-time or historical data before committing capital. |

| Automated Execution | Fast and accurate order placement with minimal manual steps, reducing the chance of execution errors. |

Best Trading Platforms With Built-In Strategy Builders

Here’s a detailed look at how leading platforms compare, starting with Options Trader by Dhan, which stands out for its advanced features and risk management capabilities.

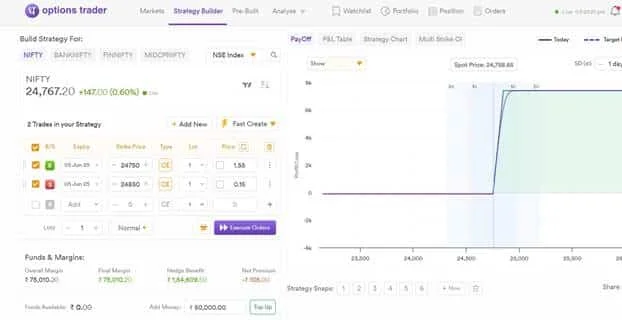

1. Dhan Options Trader: Purpose-Built for Precision in Options Trading

Options Trader by Dhan is designed specifically for options traders who require high-performance tools to plan, execute, and manage complex strategies.

Unlike other platforms that often lack automation or comprehensive risk control, Dhan’s Options Trader delivers a seamless, end-to-end trading experience tailored for both beginners and experienced traders.

Key Features of Options Trader by Dhan:

- All-in-One Strategy Builder: Build and execute complex strategies by combining calls, puts, spreads, and more within a single optimised multi-leg order window.

- Super Orders: Set entry, stop-loss, and target conditions in one go, allowing efficient execution of advanced trades with just a single click.

- Automation and Risk Control: Includes tools like OCO (One Cancels the Other) and trailing stop-loss to automate exit strategies and control downside risks.

- Longer Order Validity: Place Super Orders that remain valid for up to 365 days, offering unmatched flexibility for long-term strategic positioning and planning.

- Multi-Market Compatibility: Trade seamlessly across multiple asset classes, including options, futures, equities, and commodities, all from a single integrated trading platform.

- Strategy Testing: Backtest and fine-tune your trading ideas using real-time or historical market data to validate performance before risking real capital.

- Automated Execution: Reduce manual intervention and trading errors with lightning-fast, automated order execution based on pre-set trading rules and strategies.

- User-Friendly Interface: A clean and intuitive layout makes it easy for both beginners and experienced traders to analyse, place, and monitor trades effectively.

Also Read : Strategy for Options Trading : Exploring The Best Strategies

2. Zerodha: Basket Orders with Strong Visual Tools

Zerodha’s Basket Orders feature makes multi-leg options trading easier by allowing users to place several trades at once. While this improves coordination for complex strategies, the platform lacks integrated risk automation tools such as trailing stop-loss or OCO, which limits its flexibility compared to Dhan’s offering.

Key Features:

- Many Order Placing: Place multiple legs of an options strategy at once, ensuring all components are executed together as a single trade.

- Fancy Graphing: Use advanced charting and study tools to analyse price action, plan your trades better, and spot opportunities with ease.

- Cheap Fees: Benefit from low brokerage charges, allowing more cost-efficient trading and better returns, especially for active or volume traders.

- Plan Change: Quickly edit multiple legs—like strike, lot size, or expiry—within the same order, making strategy adjustments smooth and fast.

3. Angel One: Smart Orders with Basic Automation

Angel One’s Smart Orders tool helps simplify multi-leg option trades such as spreads and butterflies. However, it lacks advanced risk management features like trailing stop-loss, which reduces flexibility when managing open positions.

Key Features:

- Supports Spread and Butterfly Strategies: Easily create and execute multi-leg options strategies like spreads and butterflies using pre-set templates designed for quick, accurate setup.

- Real-Time Data: Access live market prices and updates instantly, helping you make informed and timely decisions during fast-moving trading sessions.

- Automated Order Placement: Automate the entire order execution process to reduce manual errors, save time, and ensure better consistency across all trade legs.

4. Upstox: Easy Strategy Building with Customisation

Upstox’s Option Strategy Builder allows users to create and modify multi-leg strategies. While it offers fast execution and basic risk tools, it does not include advanced controls like trailing stops or OCO, making it less robust for active risk management.

Key Features:

- Custom Plans: Create your own trading strategies including spreads, straddles, or butterfly setups using a flexible and easy-to-use strategy builder.

- Prompt Order Putting: Place orders quickly with access to live market prices, ensuring fast execution and better chances of meeting your entry targets.

- Risk Care: Built-in risk management tools apply basic safety rules to help limit losses and support smarter, more controlled trading decisions.

- Cheap Rates: Offers competitive brokerage fees, making it a cost-effective platform for traders looking to save money on every executed trade.

Take Control of Your Trading with Dhan’s Options Trader

With more advanced tools, traders can easily build strategies that simplify their plans and help them manage risks better. Dhan’s Options Trader combines strategy creation, testing, and automation in one platform.

The right tool lets beginners feel more confident, and advanced traders achieve better results. Be a part of the Dhan MadeForTrade community for the chance to collaborate, gain insight, and upgrade your trading skills.

Instagram

Instagram