CAGR Formula: How to Calculate Compound Growth?

Table of Contents

ToggleIntroduction

What is the first thing you would look for in your long-term investments? Simple. It should have stable returns over the investment tenure, more importantly, compounded earnings. Isn’t it obvious? But, do most long-term investments provide stable returns every year? Well, maybe for fixed deposits or a disciplined approach like a systematic investment plan. The challenge in such a scenario, where returns are distorted across the investment tenure, is to find a stable compounded investment growth rate.

Here comes the concept of Compound Annual Growth Rate (CAGR). It is a key metric for measuring average annual growth rate over a multi-year period. The purpose of CAGR is to help you make sense of the investment growth easily and make informed decisions.

In this blog, we will discuss the CAGR formula and, even as a beginner, how to calculate CAGR. We will also introduce you to the CAGR calculator and how to use it, along with an example to help you grasp the concept.

What is CAGR?

Going by the definition, Compound Annual Growth Rate (CAGR) is the average annual growth rate for any investment with a tenure of more than 1 year. As an investor, CAGR answers a big question: at what consistent rate does your investment compound steadily?

While in reality, there is no change, the returns are volatile; the CAGR formula cuts out the noise and smoothens the ups and downs in returns to give you a mean value. Unlike a simple average, CAGR is highly potent in offering a realistic picture.

Here are some scenarios where you can find the Compound Annual Growth Rate (CAGR) useful.

- Comparing Mutual Funds: Suppose you want to choose between two or more mutual funds. You can assess their performance using the 5-year CAGR to get the true annual growth, ignoring temporary fluctuations.

- Analysing Business Revenue Growth: Businesses use CAGR to pitch investors or plan strategic moves by highlighting their steady revenue percentage.

- Forecasting Future Returns: On the basis of past performance, it is easier to predict future growth with CAGR. You can use the CAGR of investment plans, especially for retirement funds, wealth funds, etc.

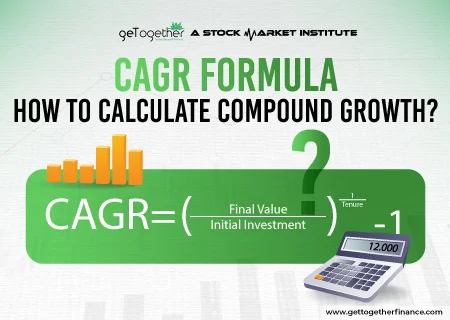

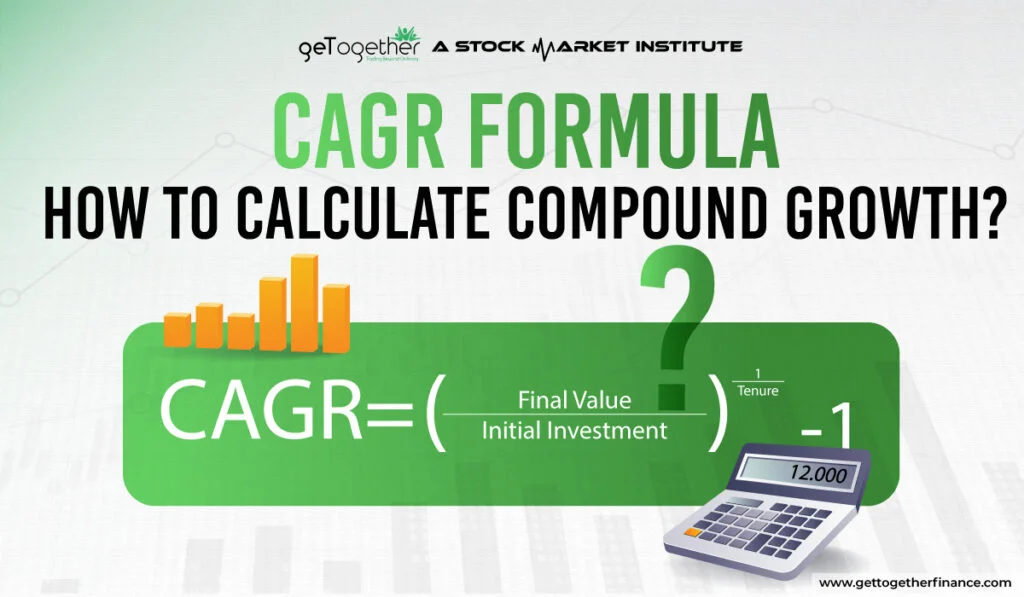

The CAGR Formula

As we already mentioned, CAGR is not just a simple average. Plus, it has to account for the compounding rate of growth. So, here’s the CAGR formula:

| CAGR=Final ValueInitial Investment1Tenure-1 |

It is evident how the CAGR formula encapsulates the exponential factor of time to work out the compounded annual growth rate. The formula gives you the constant rate at which the investment would grow throughout the tenure had the growth rate been fixed.

CAGR Calculation Example

Let’s try to understand the CAGR formula with an example.

Suppose Mr. A invests Rs. 1 lakh in a Mutual Fund for a tenure of 5 years. At the end of 5 years, the Net Asset Value is Rs. 2 lakhs. What is the CAGR of this investment?

| CAGR=Final ValueInitial Investment1Tenure-1=2,00,0001,00,00015-1=0.1487This means the CAGR is 14.87%. You can cross-check it with the compound interest formula. So, you can compare the CAGR of any project to fixed-rate investments like FDs to check whether the investment is viable or not. Instead of calculating manually, you can also use an online CAGR calculator to find out the value instantly. |

How to Calculate CAGR in Excel?

Did you know which is the favourite tool of any finance professional? Well, undoubtedly it’s Excel. You can easily calculate the CAGR in Excel with a simple formula. Let’s take our example from earlier and try to calculate on Excel:

As you can see, there are only three variables in the CAGR formula that you need to put in the Excel Sheet. Once you get the CAGR, you have to convert it into a percentage. Like 0.1487 is the decimal form of 14.87%.

You can simply apply this formula and voila, you have got your own CAGR calculator. However, we are working with much simplified data in this example. In real life, the data can be much more complicated and might need simplifying to apply the CAGR formula.

When and Why to Use CAGR?

Now that you understand the meaning and application of the CAGR formula, you must be thinking about its purpose. Where and how can you apply it in your daily life? Let’s answer these queries in this section:

Use Cases

Here are the scenarios in which the compound annual growth rate (CAGR) is useful:

- Investment Returns Over Several Years: Whether you want to invest in stocks or mutual funds, or buy real estate, anything that gives uneven returns can be analyzed using CAGR.

- Business Metrics: Businesses use the CAGR all the time to showcase the growth in key metrics like sales, revenue, profit, etc.

- Comparing Growth Rate Across Companies: You can use CAGR to not only compare different investments also compare the numbers of different companies. By applying the CAGR formula, you can understand how much a company really grows over the period.

Read More – Master the Art of Investment Management: Definition, Benefits, & Process Explained

Why It’s Useful?

Here’s why you should prefer using the compound annual growth rate instead of a simple average:

- Smooths Volatility: The actual annual returns can be volatile, and it may become difficult to analyze them. However, the CAGR formula removes this noise and gives a clearer picture of the growth trajectory.

- Offers a normalized measure: When you want to analyze the performance of an investment that gives highly fluctuating returns or materializes over a long duration, using CAGR can help you get a normalized measure.

Irrespective of anything, if you know how to calculate CAGR, you have an edge over your competitors.

CAGR vs Other Metrics

To understand the interpretation and usage of CAGR clearly, you should compare it to other similar metrics. Let’s take a closer look:

Compare With

- Simple Average Return: You must be familiar with the simple averages. It simply means adding up the returns of each year and dividing by the tenure. However, it doesn’t account for the compounding, unlike the CAGR. In such a scenario, it can mislead analysts when returns are volatile.

- Annual Return: As the name suggests, annual return is the gain or loss percentage for one year. Talking about CAGR vs annual return, CAGR takes the front seat for long-term investments. Whereas, annual return is a good metric for the short term.

- IRR (Internal Rate of Return): If you have to analyze the returns from long-term projects that involve multiple cash inflows and outflows, IRR is a great metric. Ofcourse, the IRR formula is more complex than the CAGR formula and is not ideal for calculating the returns on investments, business metrics, etc.

Highlight

- Best for long-term: Businesses or investments that grow steadily can be accurately analyzed using CAGR.

- Doesn’t capture risk: As an investor, you need to understand the risk or volatility involved in the investment. It can help you make the right decisions. However, CAGR is not ideal for it.

- Not Suitable for Volatile Returns: Suppose you buy a stock that sees exponential growth one year and crashes in the next year. Using the CAGR will distort the actual reality as it cuts out this noise.

Limitations of CAGR

While Compound Annual Growth Rate (CAGR) is widely used by analysts to study multi-year investments, it has its flaws. Let’s explore the limitations of CAGR:

- Assumes steady growth: Unlike the steady growth that CAGR projects, real-life scenarios seldom happen that way.

- Ignores volatility and interim performance: The ups and downs in returns are ignored by the CAGR formula. While it makes the CAGR effective in its purpose, it is also a limitation.

- Can be misleading in highly fluctuating markets: Some investments, like cryptocurrencies, are highly fluctuating, and the prices experience heavy upside or downside. Inspite of this, the CAGR for cryptos can be attractive.

Conclusion

In the end, the compound annual growth rate is a simple and effective tool to understand the steady investment growth for the long term. You can easily apply the CAGR formula both manually and in Excel. Alternatively, you can also use an online CAGR calculator. However, you should remember that CAGR has its limitations and should be used along with other financial metrics for comprehensive analysis.

Instagram

Instagram