Break-Even Analysis: How to Calculate it and Why it Matters?

Table of Contents

ToggleIntroduction

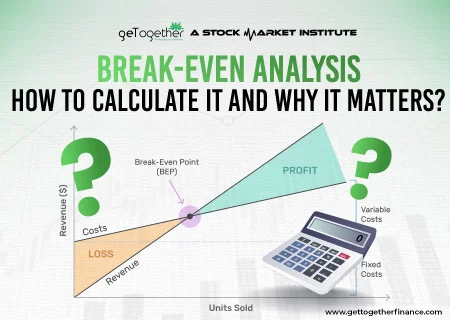

Costing or cost analysis is the most important component of any business, whether you are selling products or services. You must be aware of the two types of costs, namely, fixed costs and variable costs. The break-even point is essentially the price at which both these costs are covered by the revenue. This means no profit-no loss situation.

Break-even analysis is the foundation stone of your pricing strategy, whether you are launching a new business, a startup, or even expanding an existing business. It empowers the management to make informed pricing decisions.

Usually, the viability or feasibility of a business idea is judged by the time it takes to break even. In this blog, we explore how you can conduct break-even analysis for your business. You will also learn how to apply the break-even point formula and the key metrics like profitability, contribution margin, etc.

What is Break-Even Analysis?

Let’s dive right in and try to understand what break-even analysis is. At its core, the idea of the break-even point is the point at which the Total Revenue of a business is equal to the Total Cost. Hence, the name break-even. At this point, the profit and loss are both “0”.

If the revenue of the business grows beyond the break-even point, the business starts to turn profitable, and the excess revenue beyond this point is purely the profit margin.

But why do businesses need break-even analysis? Here’s why it is essential:

- For setting realistic sales targets.

- To develop a pricing strategy using key metrics like contribution margin and profitability.

- Planning financial budgets, business expansions, etc.

- Assessing the inherent risk and feasibility of business ventures.

Key Concepts: Fixed Costs vs Variable Costs

If you want to truly grasp control over break-even analysis, you should learn about the key concepts associated with it. Let’s take a closer look:

| Type of Costs | Properties | Examples |

| Fixed Costs | Fixed costs are fixed, i.e., irrespective of the production or sales levels, they do not change. However, if you want to expand, you need to incur additional fixed costs. | Rent, Salaries, Insurance, Office expenses. |

| Semi-Variable Costs | As the name suggests, semi-variable costs exhibit the properties of both fixed and variable costs. Till a level of production, these costs are fixed. Beyond it, they become variable. | Electricity (Fixed upto a certain level, thereafter variable on consumption), labour costs are also semi-variable |

| Variable Costs | These costs vary with the level of output or sales. | Raw materials, packaging, commissions, sales incentives. |

For the sake of break-even analysis, semi-variable costs are divided into 2 components, fixed and variable, and added to the fixed costs and variable costs, respectively.

Now you know the basic equation of the breakeven point:

| Total Cost=Total RevenueTotal Cost=Fixed Costs+Variable CostsSo, we can derive:Total Revenue=Fixed Costs+Variable CostsNow, this is true only if the number of units sold is exactly at the break-even point. What if a profitable business wants to calculate its break-even point? Total Revenue=Fixed Costs+Variable Costs+Profit |

Read More – ASSETS AND LIABILITIES

Breakeven Point Formula

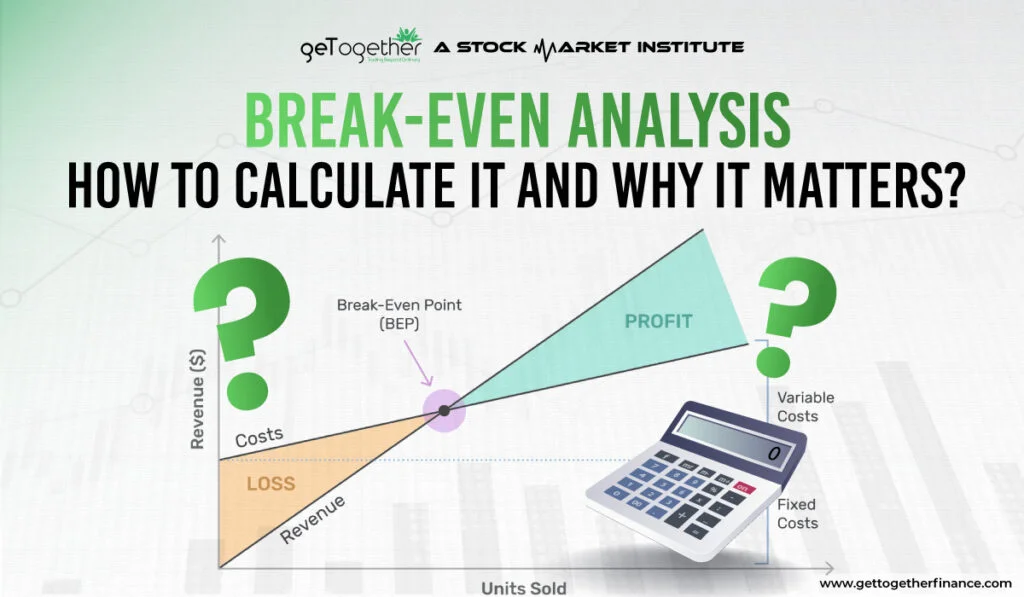

At this point, you have got the feel of the concepts and the equation of the break-even point. It is time now to go a step further and understand the break-even point formula and its derivation:

Derivation of the Formula

| Let’s try to derive the break-even point formula from the previously discussed equation:Total Revenue=Fixed Costs+Variable CostsSales PriceNo. of Units=Fixed Costs+Variable Cost per UnitNo. of UnitsSales PriceNo. of Units-Variable Cost per UnitNo. of Units=Fixed CostsNo. of Units (Selling Price-Variable Cost per Unit)=Fixed CostsSelling Price-Variable Cost Per Unit=Fixed CostsNo. of UnitsOr, at the break-even point, we can say that:Selling Price-Variable Cost Per Unit=Fixed CostsBreak-Even Point (units)Again, Contribution Margin is the amount left to cover the fixed cost and profits after subtracting the variable costs. This means:Contribution Margin=Selling price-Variable Cost Per UnitUsing this in the above equation, we can derive the basic break-even point formula:Contribution Margin=Fixed CostsBreak-Even Point (units)Break-Even Point (Units)=Fixed CostsContribution MarginNow, if you want to calculate the Break-even point in terms of revenue, you can use the following formula instead:Break-Even Point (Revenue)=Fixed CostsContribution Margin RatioContribution Margin Ratio=Contribution MarginSelling Price Per Unit |

Importance of knowing both unit-based and revenue-based break-even points

| Unit-based Break-Even Point | Revenue-Based Break-Even Point |

| It shows how many units of a product or service you need to sell to cover all the costs. | It shows how much revenue you need from products or services to cover all the costs. |

| You can use it to:Set Sales TargetsPricing StrategyProduction Planning | The revenue-based break-even is ideal for businesses with multiple products and services that have different costs and selling prices. |

If you want to maintain the financial stability of your business, it is better to know about both the unit-based and revenue-based numbers. It can help you conduct the break-even analysis accurately and take corrective measures in case of fluctuations.

Explore : Stock Market Scanner

How to Calculate Break Even Point: Step-by-Step

Now, let’s answer the burning query, “How to calculate break-even point” in a step-by-step manner:

Step 1: Determine Fixed Costs

The first step is to determine the Fixed Costs. Suppose Company A has to pay the following fixed costs:

Rent – Rs. 5 lakhs

Salaries – Rs. 3 lakhs

So the Total fixed cost is Rs. 8 lakhs.

Step 2: Calculate Variable Cost per unit

Suppose Company A incurs the following variable costs:

Raw material – Rs. 10,000 per unit

Packing cost is Rs. 2,000 per unit

The total variable cost per unit for Company A comes to Rs. 12,000.

Step 3: Set Selling Price Per Unit

The third step is to set the selling price for your product. You already know that the selling price should cover the variable cost and leave room for the contribution margin. So, let’s assume Company A sets the selling price at Rs. 20,000 per unit.

Step 4: Use the formula to compute the break-even point in units and revenue

In the fourth and final step, you actually apply the break-even point formula to get both the unit-based and revenue-based break-even point.

Real-Life Example of Break-Even Analysis

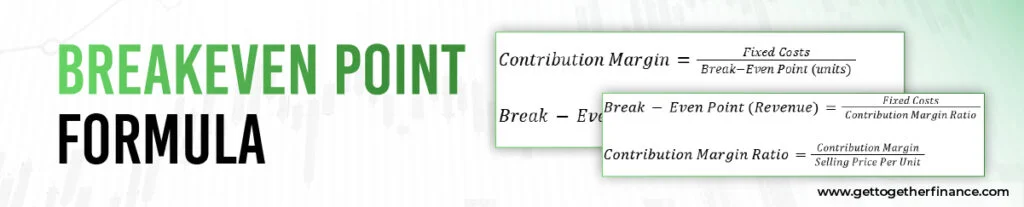

Continuing with the above example of Company A, let’s apply the formula and see how the cost-volume-profit analysis is carried out in real life.

| Contribution Margin=Selling Price-Variable Cost per unitContribution Margin=Rs.20,000-Rs. 12,000=Rs. 8,000Break-Even Point (Units)=Fixed CostContribution MarginBreak-Even Point (Units)=Rs. 8,00,000Rs. 8,000=100 unitsBreak-Even Point (Revenue)=Break-Even Point (units) Selling PriceBreak-Even Point (Revenue)=100 20,000=Rs. 20,00,000 |

Interpreting the Results

This means, Company A has to sell more than 100 units or generate a revenue above Rs. 20 lakhs to maintain its business profitability.

Now, suppose Company A thinks that the product can be sold at a price higher than Rs. 20,000 a piece, but it cannot sell 100 units. So, Company A raises the selling price to Rs. 28,000 per unit. Now, the new break-even analysis will be:

Contribution Margin=Rs.28,000-Rs. 12,000=Rs. 16,000

Break-Even Point (Units)=Rs. 8,00,000Rs. 16,000=50 units

Now, if the actual sales are more than the breakeven point, let’s say 100 units, Company A makes a profit. If the sales figures drop below the break-even point, Company A makes a loss.

From the above example, you have learned how Company A can use the break-even analysis to determine the following:

- Set realistic targets.

- Understand where the profit potential lies.

- Use a margin of safety to safeguard the business’s profitability.

- Plan to expand or restructure the cost.

Break-Even Analysis for Different Business Models

Is the break-even point formula the same for every type of industry, or do the components differ for various business models? Let’s see how different business models can draw value from the break-even analysis:

| Business Models | Key Considerations |

| Product-Based | Material, production, and packaging costs are the key. The business’s profitability depends purely on the volume or the number of units sold. |

| Service-Based | The inputs in service-based businesses are man-hours, session length, i.e., time-based. While the equipment can be a fixed cost, the variable costs usually include hourly wages, tools, etc. |

| SaaS or Subscription-Based | The fixed cost is for servers, whereas the variable costs can include Customer Acquisition Cost (CAC), churn rates, etc. The major revenue sources for such businesses are monthly recurring fees, AMCs, etc. |

| E-commerce | For an e-commerce business, the key costs include marketing, ads, logistics, transaction fees, and losses due to returns. The product revenue is directly related to the number of units sold. |

Benefits of Break even Analysis

Why do businesses need break-even analysis? Here are the key reasons:

- Strategic Pricing: To ensure business profitability, it is important that the products and services are priced strategically. An ideally priced product or service attracts customers and compels them to buy from you.

- Financial Planning: You can budget your costs and forecast the required sales to turn your business profitable.

- Cost Management: With break-even analysis, you can identify and cut unnecessary costs to improve your profit margin.

- Decision Making: You can make key business decisions like expansion, hiring, cost-cutting, etc, with this data.

- Investor Confidence: If you regularly conduct the cost-volume-profit analysis, it gives confidence to investors that you understand the business dynamics and can plan ahead of the curve.

Limitations and Considerations

Here are some of the limitations of using the break-even analysis:

- Cost Assumptions: Fixed and variable costs can both change over time. Sometimes even during a year. The calculations need to be tweaked every time for these changes.

- Ignores Demand Shifts: Market trends and consumer behaviour are completely ignored in this analysis.

- No Risk Analysis: Break-even analysis doesn’t account for competition and risk.

- Static Snapshot: Instead of giving you a dynamic model, the break-even point formula only gives a static picture.

Conclusion

If you want decision-making in your business to be simpler, you should regularly use break-even analysis. Whether you need a budget, want to set ideal pricing, improve your business profitability, or attract new investors, knowing the break-even point can help keep you on track.

Instagram

Instagram