7 Best Bearish Options Strategies to Consider

The stock market falls and rises – not just in price but also in magnitude and volume. Some periods are highly volatile, with significant price movements. These market conditions excite some traders/investors while they drag others to nail-biting situations.

Sure, you must be thinking, “People make money when markets are bullish and lose money when they are bearish,” right?

Wrong.

There are multiple bearish options strategies for trading created for such bleak market sentiments. This article walks you through the seven carefully curated approaches that will help you navigate and thrive in declining markets.

Table of Contents

ToggleWhy Use Bearish Options Trading Strategies?

Here are compelling reasons to consider incorporating bearish options trading strategies into your investment toolkit:

Profit in Falling Markets

In a bearish market, traditional “buy and hold” strategies provide limited opportunities. Bearish options trading strategies, on the other hand, enable you to actively participate in market downtrends by taking short positions and capitalizing on downside movements.

Risk Mitigation

Bearish options trading strategies help you hedge against potential losses in your portfolios during negative market sentiments. You can use various, such as stop-loss orders and predefined exit points, to protect capital and manage risks effectively.

Portfolio Diversification

Incorporating bearish options strategies adds to your portfolio diversification. When combined with existing long positions, these strategies create a more balanced approach and reduce overall risk exposure, especially during market slumps.

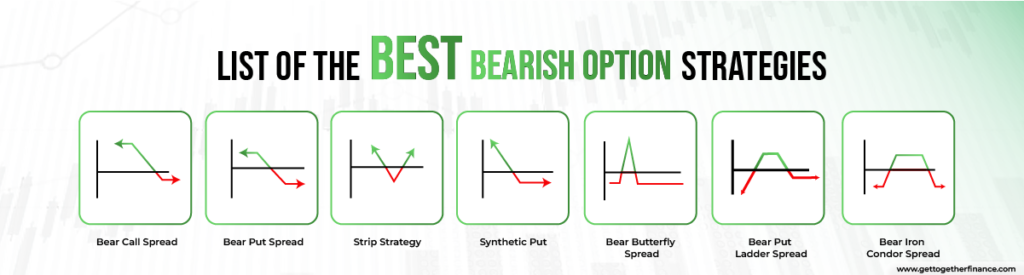

List of the Best Bearish Option Strategies

1. The Bear Call Spread

The bear call spread involves trading two call options having different strike prices but the same expiration date. Also called credit spread, this mildly bearish option strategy has two parts.

The first part involves selling a call option with a strike price below the stock’s current market price (CMP). This call option is called “in the money” (ITM) since its strike price is less than the CMP.

The second part involves simultaneously buying another call option with the same expiry date but at a higher strike price. This call option is called “out of the money” (OTM) since its strike price exceeds the CMP.

Options traders use the bear call spread strategy when they believe that the stock’s price will drop moderately or the level of fluctuation is high. This bearish option strategy is less risky as the maximum return is limited to the difference between the premium received and paid while trading options.

The potential profit is the net credit you receive, while the maximum loss is limited to the spread minus net credit (including commissions).

2. The Bear Put Spread

The bear put spread involves purchasing a put option at a higher strike price (ITM) and simultaneously writing a put option at a lower strike price (OTM). Both the options trades happen at the same expiration date and on the same stock. Also called debit put spread, options traders use this bearish options strategy to mint profits from a stock price decline.

The primary advantage of the bear put spread is that your trade’s net risk is reduced to the net amount paid (including commissions) for the options. Moreover, you get maximum profit when the stock’s price closes below the lower strike price at expiration.

Furthermore, this mildly bearish options strategy works well in modestly declining markets. As such, the lower the stock price goes, the more profit you extract.

3. The Strip Strategy

You can use the strip strategy if you are heavily bearish on stock markets and bullish on volatility. In this bearish options strategy, traders buy two put options for each call option, all on the same underlying stock, strike price, and expiration date. All the options are called “at the money” (ATM), as the strike price is identical to the CMP.

While the strip is considered a neutral to bearish option strategy, your profit surges as the stock’s price falls substantially instead of rises. Moreover, you experience maximum loss when the stock’s price inches closer to the strike price of all the three options traded.

As such, the strip strategy offers almost unlimited profit and limited loss.

4. The Synthetic Put

The synthetic put is ideal for traders with a bearish outlook on a stock’s price and who want to mimic the risk-reward profile of owning a put option. This bearish options strategy involves two separate trades. First, traders take a short position in the stock. Then, they buy a call option – at the money – on the same stock.

This combination acts like a long-put option, so you should implement this approach to safeguard your position against an unexpected rise in the stock price.

For maximum gain from a synthetic put, subtract the option premium and the lowest possible stock price (i.e., zero) from the short sale price. On the flip side, the maximum loss is limited to the stock’s selling price (where it was sold short), less the strike price, and less the call premium paid.

5. The Bear Butterfly Spread

The bear butterfly spread contains two critical steps. First, you buy two long calls at a strike price equal to the predicted stock price (ATM). Then, you buy one short call in the upper (OTM) and lower strike prices (ITM) each. Conversely, you purchase two long puts, one at a lower strike price and another at a higher strike price. Then, you sell one put option in the middle strike.

The expiration date for all these trades must be the same. Moreover, the middle strike (body) should be equidistant from the upper and lower strikes (wings). The maximum profit from this bearish options strategy is the net credit minus commissions, while the maximum loss is restricted to the net options premium paid.

6. The Bear Put Ladder Spread

The bear put ladder spread is similar to the traditional bear put spread but with an extra twist: you have to write an additional put with a lower strike price. This neutral-to-bearish option strategy involves three crucial transactions:

- Purchasing a put option at a strike price the same as the stock’s CMP (ATM).

- Selling a put option at a strike price below the current stock price.

- Selling another put with a strike price lower than the previous trade.

Traders use the bear put ladder spread when they anticipate the stock’s price will not decline considerably. However, the losses are high if the price drops more than desired. Profits are limited, with the maximum you can lock when the stock’s price lands between the strike prices of the put options written.

7. Bear Iron Condor Spread

The bear iron condor spread is a four-part options trading tactic that combines a bear call spread and a bull put spread. Here, the strike price of the short call is greater than that of the short put, with both trades having the same expiration date.

The most you gain is the net credit minus commissions. The most you lose is the difference between the strike prices of the bull put spread or bear call spread and the net credit received.

Also Read: Binary Options

How to Manage Risks?

Effectively managing risks during market downturns using bearish options strategies requires careful planning, disciplined execution, and ongoing monitoring. Here are key considerations to improve risk management:

Diversification

Spread risk across multiple bearish options trading strategies to minimize exposure to any single position. This includes bear put spreads, synthetic puts, and other techniques that benefit from downward price movements.

Position Sizing

Determine the appropriate size for each position based on your portfolio size and risk appetite. Avoid overconcentration in a single strategy or asset.

Use Stop-loss Orders

Implement stop-loss orders to exit positions if they hit a pre-determined price automatically. This helps you limit potential losses and stay ahead of volatile market movements.

Risk-Reward Ratio

Evaluate the risk-reward (R/R) ratio for each trade. Ensure that potential profits justify the associated risks in bearish market movements. The ratio helps make informed decisions on position sizing and strategy selection.

Volatility

Bearish markets often come with increased volatility. Generally, you want to purchase options when you expect volatility to rise and sell them when you believe volatility will decline. Factor this into your risk management, and consider bearish options strategies that can benefit from volatility, such as synthetic puts or the strip strategy.

Profit in a Slide

Weathering market downturns demands due diligence, and adding these seven bearish options strategies to your toolkit can be invaluable. From the versatility of bear put spreads to the precision of long puts and the strategic use of bear call spreads, each method serves as a means of hedging against bearish market conditions.

Conclusion

Successful trading requires astute analysis, disciplined execution, and a diversified approach. Strengthening your grip on these bearish options strategies not only helps you safeguard your portfolios but also capitalize on profit opportunities amid market declines.

That said, conduct thorough research and consider your risk appetite before investing your money, as options trading is a bit more risky than buying/selling stocks and traditional swing trading.

FAQ

1. What are bearish options strategies, and how do they work?

Bearish options strategies are used by traders when they bet that a stock’s price will drop. Simply put, traders make profits if the stock’s price declines as expected. There are various bearish options strategies, each having different tactics. For instance, bear call spreads involve selling call options to offset the cost of buying others, limiting potential losses. Likewise, bear put spreads combine buying and selling put options to manage risk and leverage price declines.

2. What are the key characteristics of bearish options trading?

Bearish options trading boasts the following critical characteristics:

You can profit from considerable price declines through purchasing puts or benefit from smaller drops or stagnant stock prices through selling calls.

Unlike shorting a stock, losses in bearish options strategies like spreads are capped to the premium paid.

You can use numerous bearish options strategies, including iron condors, butterfly spreads, and strips. You can tailor these approaches based on your outlook and risk tolerance.

As with any options strategy, bearish options strategies are complex and require expert guidance to understand them properly.

3. What are the common options used in bearish strategies?

Common options used in bearish strategies include bear put/call spreads, synthetic put, bear butterfly spread, and bear iron condor spread. For instance, the bear put spread strategy involves buying an ITM put option and selling an OTM put option at the same time.

4. How to determine when to use bearish options strategies?

Use bearish options strategies when you believe a particular stock’s price or the entire market will decline. Consider factors like negative market trends, weak fundamentals, or technical indicators signaling a downturn. Additionally, use bearish options strategies when you want portfolio hedging or downside protection.

5. What are some popular bearish options strategies for portfolio hedging?

Popular bearish options strategies for portfolio hedging include synthetic put, bearish iron condor spreads, and strips. For instance, the synthetic put strategy involves shorting a stock you already own and then purchasing an ATM call option for the same stock.

6. What is the impact of implied volatility and time decay on bearish options?

Implied volatility (IV) and time decay significantly impact bearish options. Higher IV increases option premiums, benefiting bearish positions. However, it also raises the upfront cost of entering such strategies. Time decay, or theta, erodes the value of options over time, whether ITM or ATM. However, this especially hurts traders if the stock price does not decline quickly enough before expiration.

Facebook

Facebook Instagram

Instagram Youtube

Youtube