What is GTT Order – Different Types of Good Till Triggered

In the fast-paced world of trading, it is essential to have tools and strategies that can help traders optimize their investment decisions. One such tool is the GTT (Good Till Triggered) order. In this blog post, we will explore what GTT orders are, the different types of GTT orders, the benefits they offer, and how they can be useful for traders.

Whether you are a seasoned trader or a beginner, understanding GTT orders can enhance your trading experience and potentially improve your investment outcomes.

What is a GTT order?

A GTT order, short for Good Till Triggered order, is a type of order that allows traders to set specific conditions for executing a trade. Unlike traditional market or limit orders that are executed immediately or at a specified price, GTT orders remain active until certain trigger conditions are met. These trigger conditions can be based on price movements, volume, or other market indicators. Once the specified conditions are met, the GTT order is triggered and executed automatically.

Types of GTT orders

- Price-based GTT orders: These orders are triggered when the price of a security reaches a specified level. For example, a trader can set a GTT order to buy a stock when its price drops to a certain threshold or sell it when the price reaches a target level.

- Volume-based GTT orders: These orders are triggered when the trading volume of a security reaches a specified threshold. Traders can use volume-based GTT orders to take advantage of significant buying or selling activity in the market.

- Time-based GTT orders: These orders are triggered at a specific time or within a specified time frame. For instance, a trader can set a GTT order to buy a stock at the market opening or sell it before the market closes.

Benefits of GTT orders

Flexibility: GTT orders offer traders the flexibility to set specific conditions for executing trades, allowing them to automate their trading strategies and reduce the need for constant monitoring.

Precision: By setting precise trigger conditions, traders can ensure that their orders are executed at the desired price or market conditions, eliminating the need for manual intervention.

Risk management: GTT orders enable traders to implement risk management strategies by automatically triggering trades based on predefined conditions. This helps in controlling losses and protecting profits.

Trading without emotion: Emotions frequently impair judgement and cause traders to act impulsively. GTT orders remove emotional bias by executing trades based on predetermined conditions, preventing traders from making hasty decisions driven by fear or greed.

How Does GTT Help You?

GTT orders can provide several advantages for traders:

Ensuring timely execution: With GTT orders, traders can avoid missing out on trading opportunities as the order remains active until the trigger conditions are met, even if they are not actively monitoring the market.

Managing multiple trades: GTT orders allow traders to manage multiple trades simultaneously by setting different trigger conditions for each order. This enables efficient portfolio management and reduces the risk of missing out on potential profit opportunities.

Maximizing profit potential: By automating the execution of trades based on predetermined conditions, GTT orders can help traders capture profits during favorable market conditions, even if they are not actively monitoring the market.

How many GTT orders can I place at once?

The number of GTT orders can be placed as per the broker’s rules and regulations. Zerodha allows 50 active GTT orders running simultaneously. Likewise, in Groww, you can place 75 GTT orders simultaneously.

Why use GTT?

GTT order is one valuable tool which you can use as per your convenience and strategic execution of the stock market. Using GTT orders offer flexibility for long term investors as they buy order at their target price. Additionally, it manages risks by automating exit points and protecting yourself from unexpected fall in the market.

Use GTT orders to enforce discipline and ensure that you stick to your pre determined buy or sell strategies and hence avoid emotional decision making in the process.

What happens when the GTT is triggered?

When the stock price hits the selected trigger price, GTT order is triggered which automatically converts the GTT order into market order by executing the trade.

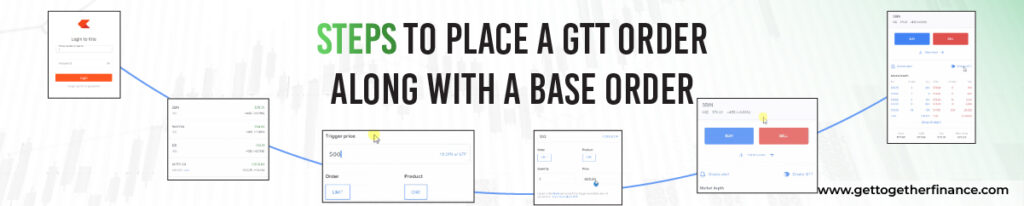

Steps to place a GTT order along with a base order

Log into trading platform >>> Select the stock for buy/sell >>> Enter the quantity and price >>> Place the Base order. After placing the base order, select the GTT order >>> place trigger price and select the quantity >>> execute the order.

Who Should Use GTT Orders?

GTT orders can be beneficial for a wide range of traders, including:

- Active traders: Traders who actively monitor the market and execute frequent trades can use GTT orders to automate their trading strategies and take advantage of specific market conditions.

- Long-term investors: Even long-term investors can benefit from GTT orders by setting trigger conditions to buy or sell securities at opportune moments, aligning with their long-term investment objectives.

- Risk-averse traders: Traders who prefer a more conservative approach can use GTT orders to implement risk management strategies and reduce the impact of emotional decision-making.

Also Read: Stop Loss Order

Examples of how GTT orders can be utilized in various trading scenarios:

- Breakout Trading: A breakout occurs when a stock price moves above a significant resistance level or below a crucial support level. Traders can use a GTT order to automatically buy a stock when it breaks out above a resistance level or sell it when it breaks below a support level. By setting price-based trigger conditions, traders can capture potential upside or downside movement in the stock price.

- News-based Trading: News events can significantly impact the price of a stock. Traders can set GTT orders to take advantage of such events. For example, if a company is scheduled to announce its earnings after market hours, a trader can set a time-based GTT order tothe buy the stock if it reaches a certain price level within a specified time frame after the earnings release. This allows the trader to react quickly to the news and capitalize on potential price movements.

- Volatility Trading: Volatility is often accompanied by increased trading volume. Traders can use volume-based GTT orders to enter trades when the trading volume reaches a certain threshold. For instance, if a stock experiences a significant increase in volume, it may indicate a surge in interest or a breakout. By setting a volume-based GTT order, traders can automatically enter a trade when the volume surpasses a predetermined level, enabling them to participate in the price movement.

- Swing Trading: The goal of swing trading is to profit from brief to moderate price fluctuations that occur within a longer trend. GTT orders can assist swing traders by automating their entry and exit points. For example, a swing trader can set a price-based GTT order to buy a stock when it pulls back to a specific support level or sells it when it reaches a resistance level. This allows the trader to take advantage of favorable price swings without constantly monitoring the market.

- Risk Management: GTT orders can also be used for risk management purposes. For instance, a trader can set a stop-loss GTT order to automatically sell a stock if its price drops below a predetermined level. This helps limit potential losses and protects the trader’s capital even if they are not actively monitoring the market.

Traders can customize GTT orders based on their trading strategies, risk tolerance, and market conditions to optimize their trading outcomes.

Conclusion

GTT orders provide traders with a powerful tool to automate their trading strategies and optimize their investment decisions. By setting specific trigger conditions, traders can ensure timely execution of trades, manage risk, and remove emotional biases from their decision-making process.

Whether you are an active trader or a long-term investor, incorporating GTT orders into your trading arsenal can enhance your trading experience and potentially improve your investment outcomes.

FAQ

What does GTT stand for?

GTT stands for Good Till Triggered.

How many GTT orders can an individual place?

The number of GTT orders an individual can place may vary depending on the trading platform or brokerage. It is advisable to check with your broker or trading platform for specific limitations.

What happens if the GTT orders are not executed?

If the trigger conditions specified in a GTT order are not met, the order remains active until the conditions are fulfilled or until the order is manually canceled by the trader.

Facebook

Facebook  Instagram

Instagram  Youtube

Youtube