“The Insider Secret” – 10 Best Ways to Earn Money in the Stock Market

Table of Contents

ToggleOverview

For 99.9% of people, investing in stocks is nothing like what you saw in Scam 1992, The Wolf of Wall Street, or Big Bull. It’s also not about so-called financial advice we see on social media or major news channels like ‘hottest stock of the season’. All of that is just noise, which won’t help you make money. The sooner you accept the fact that the stock market is not tempting, the quicker you will start making money from it.

Successful stock market investing is all about expanding your knowledge, being patient, and staying consistent in the market for many years. You don’t need to be a financial wiz or have insider tips to earn money.

Through this article, we’ll find out the 10 best ways to earn money in the stock market. So, buckle up for learning tried-and-tested strategies that will not only help you make money but also build and boost your confidence in the market.

How to Earn Money in the Stock Market

Ever noticed how countless websites on the internet claim to have the ultimate secrets to making big bucks and fat wealth in the stock market? It’s easy to feel lost and confused when everyone speaks of being the No 1 in industry. But the person who backs up their advice with the right logic and proven profitable market strategies has all the right answers for you. Let’s cut to the chase and explore the 10 easiest, best, and quickest ways to earn money in the stock market:

Start With Small Amount

“Start small, dream big” is the mantra of those who wisely invest with a humble beginning. Like planting a tiny seed that grows into a towering tree, investing low can give you impressive results over time. Don’t underestimate the power of a modest investment as it’s the first step on the way to your financial growth. With even a small sum, you can dip your toes into the big sea of investment opportunities, but don’t dive deep in the waters. Practice, understand, and empower yourself every day before swimming in the sea. Think of investing low as building the foundation of your financial future; every brick counts in constructing a sturdy fortress of wealth.

Get Acquainted with the Basics

Before you dive into the stock market, let’s start with the fundamentals. Just like learning to ride a bicycle, knowing the basics is important. Understanding key concepts like stocks, shares, and market trends will set a strong base for your stock market journey. As our elders say “ज्ञान बिना व्यवसाय कहाँ?”. So, get yourself equipped with at least basic stock market knowledge. Long way or short – everyone has their own style when it comes to learning.

You can read books, articles, business journals, follow market news, join channels or paid subscriptions, or explore online courses, seminars, and live classes. Or you can learn from the Stock Market Guru and take the first step toward learning with the “Trading in the Zone – Elementary” course with no cost at all.

Buy Low and Sell High

“Buy low and sell high” is the golden rule of investing. Like a savvy shopper, pick stocks when they’re undervalued and sell when they shine bright, unlocking profits. It’s like shopping for bargains and then selling when the price is at its peak. Just as you wouldn’t pay more for something than its worth, in the stock market, timing is everything. So, keep your eyes peeled for opportunities to buy when prices are down and sell when they soar, and watch your investments flourish!

Play the Long Buy-and-Hold Game: “Sabr ka phal meetha hota hai!”

A wise woman once quoted, “The stock market is a marathon, not a sprint”. Well! Let me tell you about the incredible power of buy-and-hold strategy. When you buy good stocks and hold onto them for the long term, it’s like planting seeds and watching them grow into huge trees. Just like you trust a favorite tree to provide shade year after year, these stocks can generate wealth steadily for way-too long.

Hence, the trick is to patiently hold onto quality stocks, and over time, you’ll reap sweet rewards like a ripe fruit.

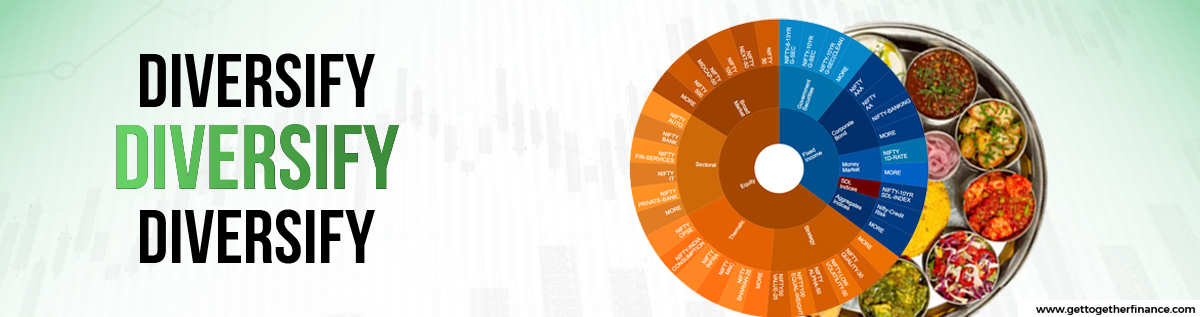

Diversify, Diversify, Diversify

Remember how a thali is filled with an assortment of multiple dishes? Diversification is your stock market thali. Spread your investments across different industries and sectors to reduce risks, just like having various goodies on your plate. This safeguards your wealth during market storms. You can also consider investing in index funds or start-up companies.

Note: 90% start-up companies collapse within the first five years unless some large company takes over the project. Scary, right! So make a wise choice or regret later.

Also Read: What to do when Stock Market is Down

Dividends: The Unexpected ‘शगुन’

Some stocks reward you with dividends, like getting unexpected shagun from relatives. These are additional earnings on your investments, providing stability even during market downturns. Hence, the advice is to invest in dividend-paying stocks to enjoy the sweetness of passive income, just like a little sugar adds flavor to life. And instead of taking the money back, reinvesting the shagun ‘earnings’ is the best choice as per some financial experts. Many brokerage companies offer DRIPs (Dividend Reinvestment Plans) that allow automatic reinvestment too.

Ride the Bull, Don’t Chase It

When the market is bullish, everyone’s excited, like kids at a mela. But remember, it’s not about chasing the bull; it’s about riding it confidently. Learn to recognize market trends and capitalize on them wisely. Don’t let your emotions cloud your decisions and trade with a calm mind. Join technical courses that will equip you with all the stock market knowledge and skills you need to ride the bull like a pro.

Become Friends with Technical Analysis

Technical analysis is like your stock market compass. It helps you read the market trends and make informed decisions. Think of it as the ‘अखबार-वाला’ (newspaper) of the stock market, telling you what’s happening and what’s likely to happen. Master the art of technical analysis, just like a skilled musician playing melodious tunes. It helps you read market trends and make informed decisions, resulting in minimized risks and helps earn more money in the stock market. Learn from the best guru and join top stock market courses to make huge money and gain remarketable growth.

Stay Alert for the Black Cats

In the stock market, black cats come in the form of risks and uncertainties. Keep an eye out for them, and stay updated with the latest news and events that can impact your investments, just like checking the weather before stepping out. You always have to look out for insider trading, market trends, and other related events to stay safe in terms of investment.

Seek Professional Mentorship/Guidance

When in doubt, seek the counsel of experts like a wise traveler asking for directions on a new journey. A guide can give you directions of the new place and save you from mistakes or wrong paths you might take. In the same way, when you’re looking to invest but feeling unsure, get an expert buddy who has got your back all the time.

Getting professional mentorship or guidance is like having a knowledgeable friend show you the way. “Trading in the Zone – Technical Analysis” do not only train you but also offer Lifetime Mentorship to all their students. Because they’ve been there, done that, and can help you make smart decisions. Don’t be shy – asking for help is like getting a map for your investment journey.

3 Investing Myths

There are numerous investing myths that have been etched into the minds of normal people. This is what refrains them from investing. Here are some popular myths in the heads of people that have no occurrence in the real stock market:

1. “I’ll wait until the stock market is safe to invest.”

Investors have this habit of waiting for the safe moment to enter the market. They have a certain belief that they can time the market, which is nothing more than a myth. Trying to exactly predict what is going to happen in the market is not relatively possible. One gets the assumptions stronger but not 100% right. Historically, the market trend has shown if you invested in stocks with strong fundamentals and technicals, then long-term returns have been positive, curbing the short-term volatility. By waiting for a perceived safe moment, investors may miss out on potential gains.

2. “I’ll buy back next week when it’s lower.

Many people have the notion of buying back when the market is low. However, it is wrong to say that you can accurately predict the short-term price changes in the market. The timing strategy is risky at many times because Markert can unpredictably move in any direction for many macroeconomic reasons. Also, changes in trading volume can lead to sudden upside and downside movement, because of demand and supply forces. Furthermore, frequent trading can result in increased transaction costs and taxes, which can reduce your profits. A preferable strategy is to invest consistently over time, known as dollar-cost averaging, which helps to mitigate the impact of market ups and downs.

3. “I’m bored of this stock, so I’m selling.”

Failure is not a good excuse to make investment decisions. Selling shares owing to a lack of excitement can mean missing out on long-term gains. Investing decisions should be based on fundamental and technical analysis, such as the company’s financial health, growth prospects, and market conditions, rather than sentiment. Successful investors rely on patience and discipline to maintain long-term investments in high-quality assets.

What Prevents a Stock Investor from Making Money?

Many times, stock investors fall into the traps of fear, greed, and impulsiveness, like a deer mesmerized by headlights. Lack of knowledge and emotional decision-making can lead to losses. As they say, “Gusse ko talwar ki nok pe rakho”, don’t let emotions drive your decisions. Trade with a calm mind, just like a skilled warrior wields his sword with precision. That’s why we have suggested courses that allow you to focus not just on techniques but also on developing the right mindset.

In A Nutshell

Imagine the Indian stock market as a vibrant marketplace, full of exciting possibilities. Just like choosing the juiciest fruit, stay informed, take your time, and invest wisely. Keep your gaze on the horizon, and you’ll reap rewards akin to the long-awaited monsoon after a scorching summer.

FAQs

Q1. Is the stock market only for professionals?

A1. Not at all! The stock market welcomes everyone. It is like a big playground where everyone is invited. You can create a demat account and start your stock market journey immediately, anytime, anywhere. But as we said earlier, remember to invest small, hold, and know more to make more smart investments.

Q2. Are these courses available in regional languages?

A2. Yes! Our courses are available in Hindi and English, making it easy for everyone to understand and learn. You can also access recorded sessions and free courses along with a knowledge archive to explore your choices more.

Q3. Can I make money quickly in the stock market?

A3. While it’s possible to make profits in the stock market, it’s essential to stay realistic and not expect overnight success. Our courses focus on sustainable and responsible investing. Investing in the stock market is like cooking good food. You have to be patient, diligent, and strategic simultaneously and practice till you become a pro.

CATEGORIES

Facebook

Facebook Instagram

Instagram Youtube

Youtube