Internal Rate of Return (IRR): Definition, Formula & Calculation

Table of Contents

ToggleIntroduction to Internal Rate of Return

One of the biggest challenges you face as an investor is correctly estimating the return on investment. Especially when the revenues from the project are scattered across many years. In such a scenario, you have to estimate the future cash flows and discount them to get their present values.

You can compare these values to the initial outlay on the project to work out the real profits. This popular method is known as the Net Present Value or NPV.

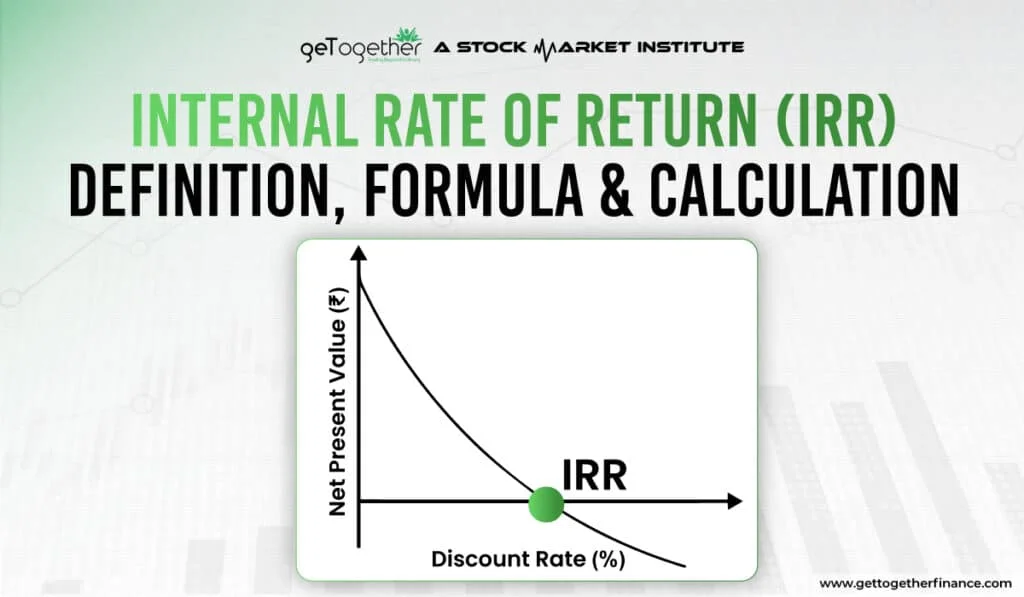

Similarly, there is another popular method of project evaluation called the Internal Rate of Return (IRR). It is a powerful tool used by finance professionals to decide whether or not a project is viable. In simple terms, IRR in finance is the discount rate at which the NPV is 0. Or in other words, the present value of the future cash flows and the initial cost of the project are equal.

It is also called the break-even interest rate because, if your cost of capital becomes equal to the internal rate of return, you will be in a no-profit-no-loss situation. Tracing its roots back to the 20th century, IRR in finance still plays a pivotal role in financial decision-making.

In this blog, we will explore the depths of the concept, how to calculate IRR, and much more.

Why is IRR Important in Finance?

Calculating the IRR is important as it gives insights into the profitability of a business proposal. But what are the uses of IRR in the real world? Let’s explore in this section:

| Financial Decisions | Role of IRR |

| Capital Budgeting | IRR in finance is a benchmark for assessing and deciding whether a new project is viable. The companies calculate their required rate of return (or the hurdle rate) by factoring in the cost of capital, business costs, and profit margin. Then they calculate the IRR for the project. If the internal rate of return is higher than the required rate of return, the project is considered viable. |

| Evaluating Projects | Now we have talked about how companies evaluate projects using Capital Budgeting. But there are multiple projects to consider at a time. In such a scenario, calculating the IRR can help in making the right decision.The comparison is made easier as IRR is in the form of a percentage, which is easily comparable for various projects. |

| Personal Investment Decisions | Is the internal rate of return only relevant for businesses? No. Even individuals can use the metric to compare various investment opportunities like real estate, mutual funds, annuity funds, retirement plans, etc. IRR is the compounded annual growth rate (CAGR) for investments and is a better metric to make informed decisions. |

| Comparing Investment Opportunities | You can use the IRR calculation as a yardstick to measure and compare the profitability of different investment opportunities like stock options, property, startup funding, etc. |

Read More – What is Finance: Definition, Types, And Importance Explained

Understanding the IRR Formula

Presenting the IRR formula

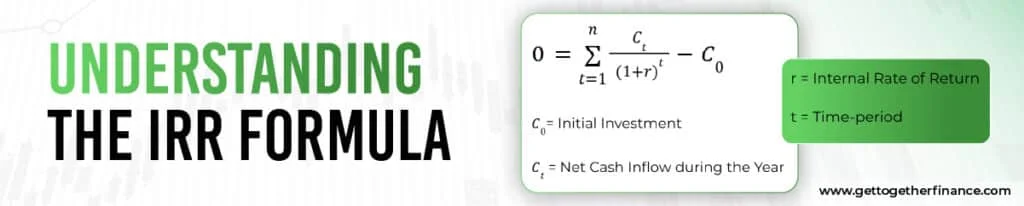

After explaining IRR, it is time to introduce you to the formula:

| 0=t=1nCt(1+r)t-C0C0= Initial InvestmentCt = Net Cash Inflow during the Yearr = Internal Rate of Returnt = Time-period |

You find the solution to this equation, you get the “r” or the Internal Rate of Return. Looks complex, right? But it isn’t. We will find out in just the next section.

How is the formula derived from Net Present Value (NPV)?

If you are familiar with the concept and the formula of Net Present Value (NPV), the IRR calculation is not very difficult for you. Let’s understand what the formula is saying by expanding the IRR formula for 5-year cash flows:

| 0=C1(1+r)+C2(1+r)2+C3(1+r)3+C4(1+r)4+C5(1+r)5 |

Doesn’t it look familiar? Yes. It is the NPV formula. Except, you would usually have the discount rate (r) and find the NPV. Whereas in IRR calculation, you know that the NPV is 0 and want to calculate the discount rate (r), which is the IRR.

By looking at the above formula, you can easily sense that IRR is the break-even discount rate of the NPV equation. If the required rate of return is below this, it is a winner.

Read More – How Company Valuation Works: A Simple Guide for Business Owners

How to Calculate IRR: Step-by-Step

Now, the above situation presents a deadlock as there are multiple powers for the variable “r”, and solving it is next to impossible for a layman. How to calculate the IRR in such a situation? So, you can use any of the following methods to reach the answers:

Manual Trial and Error with Interpolation

Conventionally, the trial and error method uses multiple test numbers for the IRR until the resulting NPV becomes 0. You simply fill in the value for “r” and try to get the NPV to zero. However, you can make life easy for yourself using interpolation.

You can take 2 wild guesses for “r” and get the resulting NPVs in both cases. Now, apply the following interpolation formula to get the internal rate of return.

| IRR=r1+NPV1NPV1 – NPV2(r2-r1) |

This method gives you the IRR instantly with minimum effort in trial and error.

Using the =IRR() Function on Excel/Google Sheets

You get a direct function for IRR calculation in Excel/Google Sheets. Just fill in the data and apply the formula as demonstrated here:

Using Financial Calculators or Software

If you want an automated software for IRR calculation, you can use online financial calculators or finance software like Tally, SAP, etc. To get the result, you need to enter all the cash inflows and outflows for each year correctly.

Here are some key points to consider during IRR calculation:

- Ensure the data is for consistent time periods.

- Include all cash inflows and outflows, including the salvage/resale/scrap value.

- Use the simplest method at your disposal.

What is a Good IRR?

A good internal rate of return depends on your needs. If you are a conservative investor, a moderate IRR of 10-15% can suffice. However, for more risky investments like real estate, stocks, startups, etc, you may require a higher IRR, like over 20%.

IRR Example

Let’s take the example of the IRR calculation we used to understand the Excel Function:

| Year | Cash Flows (in INR) |

| 0 | -5,00,000 |

| 1 | 50,000 |

| 2 | 1,50,000 |

| 3 | 3,00,000 |

| 4 | 5,00,000 |

| 5 | 8,00,000 |

| IRR Calculation | Apply the IRR Function in Excel and select all the cash flows you need to include. The result comes to 40.04%. |

As you can see, a high IRR shows that the project is lucrative, but risky. Most of the cash inflows are in the 4th and the 5th year, which can also be uncertain. Even the payback period is 3 years. Hence, if you are a conservative investor, as per the internal rate of return, this project is not viable.

IRR vs NPV: What’s the Difference?

| Points of Difference | Internal Rate of Return | Net Present Value |

| Concept | IRR in finance is a measure of the absolute profitability, a percentage that is comparable directly to the cost of capital. | NPV, on the other hand, gives the present monetary value of the future cash flows, considering the time value of money. |

| Use | It is more useful to calculate IRR when you have a constrained budget or have multiple choices of similar size to pick from. | With NPV, you can assess and compare projects of different sizes and make the right choice depending on your needs. |

| Pros | As the internal rate of return is in the form of a percentage, it is directly comparable. | If you want to know your returns in monetary form, NPV is more useful. |

| Cons | In some cases with alternating cash flows, you can get multiple IRRs, which can be confusing. | It is less intuitive for comparison as it gives numbers rather than percentages. |

Limitations and Drawbacks of IRR

While the internal rate of return is a useful tool, it has certain limitations. Let’s take a look at them:

- Multiple IRRs (Non-Conventional Cash Flows): If a project has multiple and alternating cash outflows/inflows, you can get more than one result in the IRR calculation. Instead of giving clarity, it can be confusing for decision makers.

- Unrealistic reinvestment assumptions: One of the biggest unrealistic assumptions of the IRR is that all the cash flows for the year are immediately reinvested at the rate of the IRR.

- IRR doesn’t reflect project scale: IRR can be high for a smaller, insignificant project and low for a bigger project. But you cannot form your decision only based on the IRR, as there can be many other variables involved, like follow-up projects, idle capital, work experience, etc.

- Misleading in mutually exclusive projects: When you have to choose between two or more projects that are mutually exclusive, i.e., they don’t have similar processes, using the internal rate of return can mislead you into making the wrong decision.

When and How to Use IRR in Real Life?

Here are some scenarios where using the internal rate of return can come in handy for decision-making in real life:

| Scenarios | IRR Uses |

| Evaluating Investment Portfolio | When you hold multiple financial assets in your investment portfolio, like stocks, SIPs, mutual funds, etc, you can compare their returns using the IRR. |

| Startups and Venture Capital ROI projections | Startups are high-risk, high-return investments, and investors can choose the ideal projects using the internal rate of return. |

| Real Estate Project Assessment | You can assess projects with multiple cash flows using IRR. Hence, it can account for the rental income, capital gains, and holding period. This makes it ideal for real estate projects. |

| Leasing or Buying Decisions | Using the IRR calculation, you can assess whether it is better to lease or buy premises, equipment, machinery, etc. |

Pro Tips: Improving Your IRR Analysis

Now that you understand the IRR concept, calculation, limitations, etc, here are some tips to make your life easy:

- Combine IRR, NPV, and Payback Period: Using the IRR alone can be misleading. You can combine it with other metrics like the NPV and payback period to make more sense of the data.

- Adjust IRR for Inflation or Risk: The IRR calculation doesn’t account for inflation. It is better to use the real IRR (inflation-adjusted) by applying the risk premium to the discount rate.

- Avoid IRR for Large Projects: Large-scale projects are valuable for companies to grow. Hence, you should not rely solely on IRR. Couple it with tools like DCF, scenario testing, cost-benefit analysis, etc.

- Use Scenario Analysis and Sensitivity Testing: Testing the IRR is important. You can run the best and worst-case scenarios to check the sensitivity of the slightest changes to the IRR calculation.

Conclusion: Is IRR the Right Metric for You?

The internal rate of return is a valuable tool in finance for evaluating projects and investment opportunities. The IRR calculation provides the profitability of an investment in percentage terms, which is directly comparable to the cost of capital. While you can easily calculate IRR using Excel function or software, the IRR disadvantages and limitations make you prone to wrong decisions. Using IRR in finance, along with other metrics like NPV and payback period, can help in making the right choices.

Instagram

Instagram