Tweezer Bottom Pattern: Meaning and What It Indicates?

In a rapidly changing world, investors look for quick money instead of patiently investing in long-term conventional investments. As a result, the stock markets have gained a great deal of attraction from the young population.

With the flexibility of fluid funds, you can choose to block your funds for short-term trading or long-term investing. The markets provide high liquidity for you to maneuver according to your needs. However, stock markets are volatile and can lead to heavy losses if you invest recklessly.

Investors use tools like fundamental and technical analysis to understand the stocks. These tools help minimize the investment risk. One such technical analysis indicator is the tweezer bottom pattern. In this blog, we cover all the ins and outs of this pattern.

Table of Contents

ToggleWhat Is Tweezer Bottom Double Candlestick Pattern?

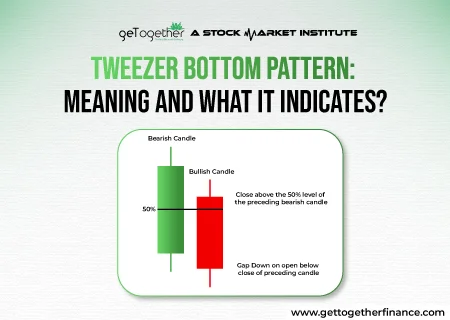

Have you heard about the candlestick charts? These are the most widely used chart types by investors to identify lucrative investment opportunities. The tweezer bottom pattern is one of the powerful candlestick patterns that shows trend reversal. It gets its name from a pair of tweezers, a tool having 2 arms similar to the grip of tweezers.

Here are the key characteristics of the tweezer bottom candles:

- Formation: It consists of 2 or more consecutive candles at the bottom of a downward trend:

- 1st Candle is the bearish candlestick (Red)

- 2nd Candle is a bullish candlestick (Green)

- Almost equal low prices: All the candlesticks should have an almost equal lower price.

As you can see in the above image, 3 consecutive candles form a similar low, showing the existence of a tweezer pattern. Usually, the tweezer bottom pattern consists of 2 candles only, but sometimes it can have 3 candles as well.

Also Read: Symmetrical Triangle Pattern

What Does Tweezer Bottom Pattern Indicate?

Having seen how the pattern looks, you would ask what does the pattern say? Here’s how you can interpret it:

- Indication: The pattern shows that sellers are exhausted and buyers have gained momentum. So much so that the trend is reversed from bullish to bearish.

- Strong Level: The tweezer bottom shows that buyers have created support for the stock price at this level to prevent the price from falling any further.

- Confirmation: The mere formation of a tweezer bottom is not enough. If it is accompanied by the following, the pattern is considered strong:

- Follow-up candles forming higher highs

- Other bullish candlestick patterns are forming

- Higher volumes

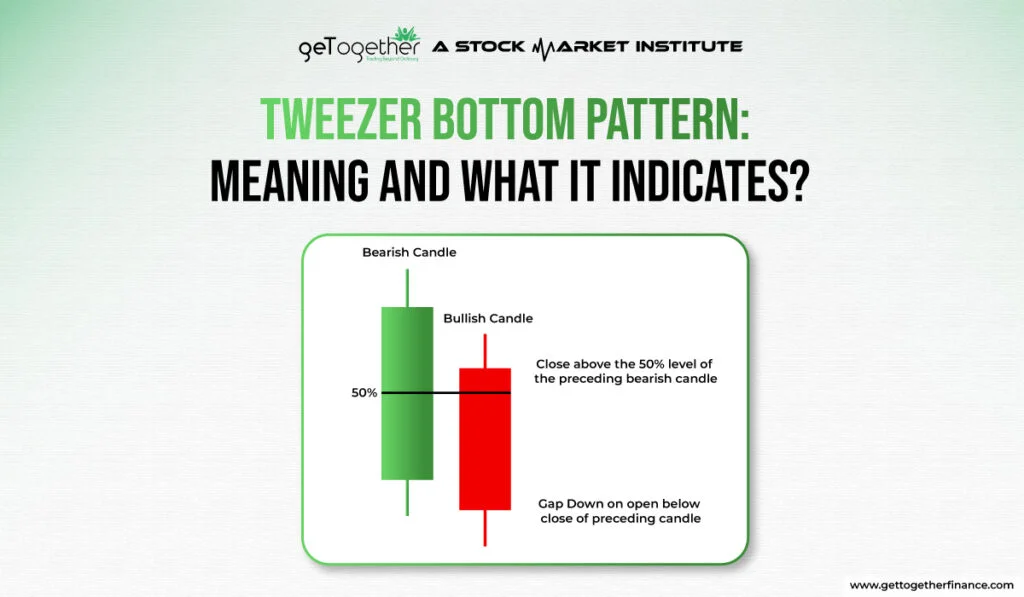

Importance of The Tweezer Bottom Pattern for Stock Market Technical Analysis

The tweezer bottom chart is significant for technical analysis. Here’s why traders give it such high weightage:

- Strong Pattern: It is inherently a strong pattern.

- Trend Reversal: The strength of the pattern is shown by the fact that buyers not only restrict the selling pressure but also reverse the trend.

- Confirmation: It is easy to confirm as a bullish candle following the tweezer bottom is enough.

- Entry & Exits: It’s easier to identify the entry & exit points in the tweezer bottom pattern.

Restrictions while using the Tweezer Bottom pattern

While a tweezer bottom is a strong pattern, it is not foolproof. In such circumstances, if you don’t follow certain restrictions and make impatient moves, it can be disastrous. Here are certain steps you should follow:

- Always wait for the confirmation: Additional technical indicators along with the tweezer bottom pattern like:

- Higher highs formed by candlesticks

- Bullish candlestick patterns, and

- Increased volumes

- Market & Economic Condition: It is also important to check the condition of the stock market & the economy overall. Sometimes individual stocks can react to a larger move of the stock market.

- Consider the timeframe: A tweezer bottom pattern built over a longer period is stronger compared to a shorter timeframe.

- Beware of false signals: You can never be 100% sure about any technical chart pattern. What if the same candlesticks form a tweezer top and bottom? This may cause uncertainty, leading to a tweezer cross. In such a situation, traders cannot predict anything, and prices can break out in any direction.

Example of a Tweezer Bottom Pattern

Here’s an example of the tweezer bottom pattern:

Stock: Reliance Industries Limited

Exchange: NSE

Dates: 12th & 13th August 2021

Chart Time: Daily

| Particulars | 12th August 2021 | 13th August 2021 | 16th August 2021 |

| Type of Candle | Bearish | Bullish | Bullish (Higher Highs) |

| Lower Price | Rs. 2,105.00 | Rs. 2,108.95 | Rs. 2,128.15 |

| Higher Price | Rs. 2,126.20 | Rs. 2,149.90 | Rs. 2,203.00 |

| Volumes | 37,55,507 | 58,98,384 (1.57 times) | 1,01,23,204(2.70 times) |

Interpretation:

- A tweezer bottom formation is clearly visible.

- The lowest price of both bullish & bearish candlesticks is in close proximity.

- All the candles are making higher highs

- The volumes have grown more than 1.5 times on day 2 & 2.7 times on day 3

Result:

- The stock price touched a high of Rs. 2,480 on 6th September 2021

- The up move continued until a strong tweezer top was formed on 19th & 20th October 2021 at price levels around Rs. 2,750

- If you entered the trade at the right time, you could have gained up to 30% within the span of 2 months

From the above tweezer bottom example, you can see that if you perform good research and study all the parameters discussed earlier in this blog, you can expect good returns with minimum risk.

Tweezer Bottom Pattern Reliability In Different Timeframes

The reliability of the Tweezer Bottom Pattern varies significantly depending on the timeframe (intraday, weekly or daily) for which it is formed. The accuracy improves when each candle shows a larger volume of price action. A longer timeframe includes more market data, which boosts the pattern’s validity.

Let’s understand it properly from the given table:

| Timeframes | Reliability | Reason | When it Works Best | When it fails |

| Intraday (1m-15m) | Low-Moderate | A lot of market clutter, liquidity grabs and false reversal attempts | At HTF zones, during news-induced reversal, confirmed by increasing volume | During an unstable market, and when the trend is heavily bearish |

| 1H/4H | Moderate | Less noise, clear structure | With trendline support and RSI divergence | When trading activity is low, and the price is stuck in a sideways phase |

| Daily (D1) | Moderate-High | Indicates that large institutions are supporting that level | At a strong demand zone, after a heavy selloff | When the broader trend is very bearish |

| Weekly (W1) | High | Shows major demand, long-term positioning | At multi-year support+ high volume | Fail occasionally-mainly during a broad market downtrend |

“Equal low in the consecutive bar indicates that bears tried twice and failed. That rejection generally gives the first signal of an upcoming bullish shift”–Steve Nison.

Tweezer Bottom vs Other Bullish Patterns

Let’s understand it with the help of a table:

| Features | Tweezer Bottom Pattern | Morning Star | Piercing Line |

| Number of Candles | 2 candles | 3 candles | 2 candles |

| Main Structure | Both candles form matching or very close lows | The structure of the morning star develops over 3 candles, which include a big bearish candle, a small indecisive candleand a strong bullish candle | The structure of the piercing candle is made from a large bearish candle and a bullish candle that starts lower yet closes above half of the earlier bearish candle’s body |

| Key Indication | Buyers are strongly holding the price at the key support area | Clear move from selling pressure– buyer control | Strong bullish recovery after the crash |

| Reliability/Strength | Moderate | High | Moderate–High |

| Psychology | The same low is continuously held by buyers, while sellers are not able to drive it lower | Sellers lose momentum– indecision– buyers take over strongly | Demand surges, erasing a large portion of the earlier bearish move |

| Risk of failure | High in a strong downtrend | Low if properly structured | Moderate if a bullish candle is weak |

| Stop-Loss placement | Below the equal lows | Below the indecision candle | Below the bullish candle low |

| Work Best When | At major supply/demand zones | After an extended downtrend | After a sharp fall |

| Trader Type Suited | Support-based trader | Trend-reversal swing trader | Aggressive reversal trader |

“When the price touches the same support level two times and does not go below it, then reflect potential in an intraday reversal and fatigue in the selling pressure”–Linda Raschke.

Can the Tweezer Bottom Candlestick Pattern Fail?

Yes, the Tweezer Bottom Pattern can fail, and it’s crucial to understand why it fails. Below is a proper breakdown:

Why the Tweezer Bottom Pattern Fails?

Common reasons are:

- When the tweezer bottom candlestick pattern forms at an unsteady or weak support level.

- If there is low buying volume on the reversal candle.

- When there is low volume on the second candle.

- When the tweezer bottom candlestick pattern forms in the middle of a strong downtrend.

- If there is a lack of confirmation from indicators.

- Due to stop-hunting and liquidity garbs.

What Do Failed Setups Look Like?

Below are some common signs on the chart that signify a failed tweezer bottom candlestick pattern:

- A weak bullish candle as a second candle

In a tweezer bottom pattern, when the second candle is a small bullish candle with a narrow body and low volume, it indicates weak buying behaviour. Furthermore, there is no momentum behind the reversal, which depicts that buyers don’t have enough power to move the market direction.

- Sideways Move After Pattern (No follow-through)

Sometimes, the charts display a tweezer bottom, but rather than increasing, the price shifts sideways with no bullish continuation. This lack of continuity indicates that the pattern lacks underlying strength. The price moment pauses and causes market drops

- Indicator does not confirm the Pattern

Generally, a failure occurs when the trend indicator, RSI or Volume gives no support to reversal. The price continues to decline, while RSI does not signal oversold conditions, and trading volume remains low.

- Price Breaks Below the Tweezer Lows Immediately

Another failed setup happens when the price forms a Tweezer Bottom, and the next candle closes both lows below. This shows that the buyer was not in control, so the price decreased further without resistance.

- Rejection Wick on the Second Candle

A bullish candle with a long upper wick indicates that buyers fail to hold prices higher and sellers reduce it. This shows weak reverse strength.

- Tweezer Bottom Forms Away From Support

When the tweezer bottom forms away from main support, then there is strong buying interest behind it.

Pro Tip: Always look for a long lower wick on the second candle.

“A deep wick = strong rejection = strong bullish conviction.”

Trading Tweezer Bottom Patterns

Now that you have seen how to identify the pattern correctly, the next query is about the Tweezer bottom entry & exit levels while maintaining a practical stop loss.

- Entry Level: The opening price of the 4th candle, i.e. right after the confirmation candle when you are certain about the formation.

- Stop Loss: You can place the stop loss below the lower wick of the 2 tweezer candles.

- Exit Level: Your exit level can be any of the following targets:

- Based on the height of the pattern

- Based on the support/resistance levels

- When you see reversal signals like tweezer top

Mistakes Traders make while trading the Tweezer Bottom

At this stage, you are well equipped to understand a tweezer bottom and ride the tide. But, the biggest mistakes you can make as a trader are being complacent or overconfident. Well, here are some of the mistakes you should avoid while entering a tweezer bottom trade:

- Not confirming the pattern: If you miss the trick to confirm the pattern, you might suffer a loss.

- Not Putting a Stop Loss: Humans are prone to errors. Instead of making it an ego point, you should maintain a stop loss to minimize your risk. Otherwise, you might end up eroding your corpus.

- Ignore Reversal Signals: If you become greedy and ignore the indications of trend reversal, it can lead to losses. To avoid this, you can also put a trailing stop loss, i.e. putting a stop loss at upward prices to avoid losing the profits.

To Sum it Up…..

- Bullish Reversal: Tweezer Bottom shows a trend reversal towards a bullish move.

- Exhaustion of Selling Pressure: Equal lows suggest that the selling pressure has been exhausted and buyers are on top.

- Confirmation: Higher highs and increased volumes are a litmus test for a tweezer bottom pattern.

- Entry, Exit & Stop Loss: Identifying the appropriate entry, exit & stop loss can maximize your profits.

- False Signals: If the same candles form tweezer bottom & top patterns, it shows indecision. Such false signals can be dangerous with half knowledge.

Exit Strategy: Exit the trade based on predetermined targets, reversal signals, or trailing stop-loss orders.

FAQs

What is the Tweezer Bottom pattern in trading?

It is a bullish reversal pattern observed in candlestick charts. It is formed when two consecutive candlesticks with almost equal lows are seen on the chart. It indicates the potential exhaustion of selling pressure signalling a reversal from a downtrend to an uptrend.

How is the Tweezer Bottom pattern identified on a price chart?

Tweezer Bottom is formed when two consecutive candlesticks having almost equal lows are seen on a price chart. If the pattern is followed by a candle making higher highs along with increased volumes, it indicates a strong formation.

Can you explain the significance of the Tweezer Bottom pattern?

The Tweezer Bottom pattern signifies the potential exhaustion of selling pressure and a shift from a downtrend to an uptrend. It provides traders with a bullish reversal signal, indicating a favorable opportunity to enter long positions to benefit from the upward price movements.

What are the key characteristics of a Tweezer Bottom?

Key characteristics include:

Two consecutive candlesticks with similar lows

Indicates a reversal from a bearish to a bullish trend

A strong formation is accompanied by higher highs and increased volumes

Shows the entry & stop loss levels that can help you gain good profits at minimum risk

How does the Tweezer Bottom pattern indicate potential market reversal?

The stock markets experience a continuous tussle between the buyers and the sellers. Tweezer Bottom pattern indicates the buyers exhausting the selling pressure and reversing the trend to gain bullish momentum. This pattern implies that buyers are stepping in to support the price at that level and prevent it from falling any further.

Are there variations or types of Tweezer Bottom patterns?

Yes, variations of the Tweezer Bottom pattern include:

Long Lower Shadow: When the lower wick of the first candlestick is significantly longer than the second candlestick’s lower wick.

Engulfing Tweezer Bottom: When the second candlestick completely engulfs the first candlestick, indicating stronger bullish momentum.

In what market conditions is the Tweezer Bottom pattern commonly observed?

As a Tweezer bottom pattern shows a trend reversal from bullish to bearish, it is commonly observed in markets experiencing downtrends or periods of heavy selling pressure. It indicates the potential exhaustion of selling momentum and a shift in sentiment from bearish to bullish. Traders look for this pattern to identify opportunities to gain from short-term trades.

How do traders typically interpret the confirmation of a Tweezer Bottom?

Traders typically confirm a Tweezer Bottom pattern by observing subsequent price action, such as:

Bullish candlestick patterns or higher highs,

Increased trading volume accompanying the confirmation

Are there specific volume considerations when trading the Tweezer Bottom pattern?

Yes, traders consider volume when trading the Tweezer Bottom pattern. High volume suggests strong market participation and enhances the reliability of the pattern as a potential reversal indicator.

What precautions should traders take when relying on the Tweezer Bottom pattern for decision-making?

Traders relying on the Tweezer Bottom pattern should take the following precautions:

Confirmation: Wait for confirmation from subsequent price action.

False Signals: Be aware of false signals and verify with other technical indicators.

Market Context: Consider broader market conditions and volatility.

Risk Management: Implement proper risk management techniques to protect against losses.

Facebook

Facebook Instagram

Instagram Youtube

Youtube