Anchor Investors: Who They Are and Why They Matter in IPOs

Table of Contents

ToggleOverview

When a company goes public through an Initial Public Offering (IPO), the allocation of shares to different investor categories is a crucial process. While the majority of investors participate in the public issue, a select group gains early access. These are the anchor investors. They are institutional investors who invest a big chunk of money before its shares are offered to the general public. Every company goes through an exhaustive process to select their anchor investors. This blog will explore what is anchor investors meaning, how they work, and what is their significance in the world of IPOs.

So without wasting a jiffy, let’s begin with.

Who Are Anchor Investors

Anchor investors are institutional investors who are allotted shares in an IPO before it opens for retail investors. They are typically large mutual funds, insurance companies, sovereign wealth funds, etc. who offer stability to the IPO by committing to hold the shares for a certain period of time. In simpler terms, they are the first ones to get shares in a company’s IPO (Initial Public Offering) before it opens for regular investors. SEBI introduced anchor investors primarily in 2009 to stabilise the IPO market and enhance investor confidence. The concept provides investors an opportunity to subscribe or buy up to 30% of the quota in an IPO.

Role of Anchor Investors

Before going further, it is crucial to understand the role of anchor investors in IPO world. This will help you decode its importance for the listing companies as well as investors;

- Offer Stability: When big, reputable investors like anchor investors buy into an IPO, it signals their commitment and credibility in the company’s future. This gives confidence to other investors.

- Price Discovery: The demand from anchor investors helps the company and investment bankers decide on the right price range for the IPO shares.

- Boost Subscription: They typically buy a large portion of the IPO shares. This gives the IPO a good start and makes it more likely to be fully subscribed by other investors.

- Lock in Period: Anchor investors are typically locked-in for 30 days from the date of allotment. This prevents the share price from falling immediately after listing and provides stability.

How are Anchor Investors Selected?

The allocation to these investors is set by SEBI and each company goes through a comprehensive process to select their anchor investors. Here are some aspects that are considered typically before selecting anchor investors in a company:

- The company and investment bankers decide which investors to invite based on their reputation and financial strength.

- Anchor investors must apply for at least ₹10 crore worth of shares.

- Up to 60% of the IPO shares can be allocated to these investors.

- The anchor investor portion is not open for retail investors.

Anchor Investor Lock In Period

With every commitment to the IPO, these investors are bound to hold the purchased share for a specific period, called the Lock in period. This system is designed to provide stability to the stock price after the IPO is launched.

- Initial Lock In Period: They are required to hold 50% of their shares for 30 days from the date of the IPO allotment.

- Subsequent Lock In Period: The remaining 50% of their shares must be held for 90 days after the IPO allotment.

Anchor Investor SEBI Guidelines

The Securities and Exchange Board of India (SEBI) classifies anchor investors as Qualified Institutional Buyers (QIBs). It is crucial for these investors to bid or buy IPO a day before it goes public to ensure their genuine commitment toward the offering.

One-third of the anchor investor portion is reserved for domestic mutual funds. A single mutual fund cannot bid for more than 60% of the QIB portion under the anchor investor category.

Also Read: Anchor Units and Offset Units

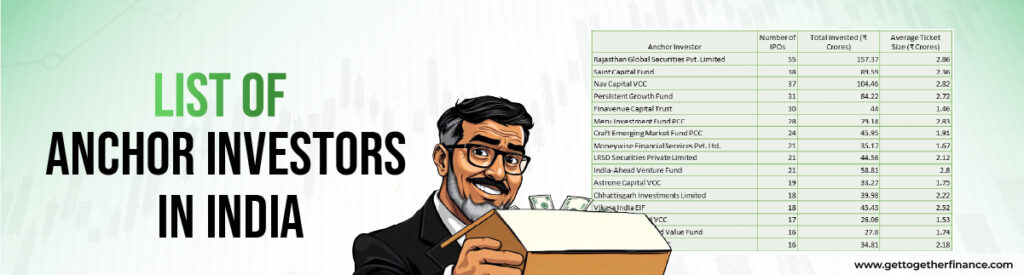

List Of Anchor Investors In India

Here’s a list of some notable anchor investors in IPOs of India based on the search results:

| Anchor Investor | Number of IPOs | Total Invested (₹ Crores) | Average Ticket Size (₹ Crores) |

| Rajasthan Global Securities Pvt. Limited | 55 | 157.37 | 2.86 |

| Saint Capital Fund | 38 | 89.59 | 2.36 |

| Nav Capital VCC | 37 | 104.46 | 2.82 |

| Persistent Growth Fund | 31 | 84.22 | 2.72 |

| Finavenue Capital Trust | 30 | 44 | 1.46 |

| Meru Investment Fund PCC | 28 | 79.14 | 2.83 |

| Craft Emerging Market Fund PCC | 24 | 45.95 | 1.91 |

| Moneywise Financial Services Pvt. Ltd. | 21 | 35.17 | 1.67 |

| LRSD Securities Private Limited | 21 | 44.58 | 2.12 |

| India-Ahead Venture Fund | 21 | 58.81 | 2.8 |

| Astrone Capital VCC | 19 | 33.27 | 1.75 |

| Chhattisgarh Investments Limited | 18 | 39.98 | 2.22 |

| Vikasa India EIF | 18 | 45.43 | 2.52 |

| LC Radiance Fund VCC | 17 | 26.06 | 1.53 |

| Negen Undiscovered Value Fund | 16 | 27.8 | 1.74 |

| Zinnia Global Fund PCC | 16 | 34.81 | 2.18 |

List of Mutual Fund Anchor Investors in India

Here are a prominent list of mutual fund anchor investors in India:

| Anchor Investor | Type |

| ICICI Prudential Mutual Fund | Mutual Fund |

| HDFC Mutual Fund | Mutual Fund |

| Edelweiss Mutual Fund | Mutual Fund |

| Nippon India Mutual Fund | Mutual Fund |

| Aditya Birla Sun Life Mutual Fund | Mutual Fund |

| BNP Paribas Arbitrage | Institutional Investor |

| SBI Mutual Fund | Mutual Fund |

| Axis Mutual Fund | Mutual Fund |

| Franklin Templeton Mutual Fund | Mutual Fund |

| UTI Mutual Fund | Mutual Fund |

| Integrated Core Strategies (Asia) Pte Ltd | Institutional Investor |

| Aditya Birla Sun Life Insurance Company | Insurance Company |

| Government Pension Fund Global | Sovereign Wealth Fund |

| Bandhan Mutual Fund | Mutual Fund |

In Brief

Anchor investors are the cornerstone of a successful IPO. Their significant investments not only provide stability to the issue price but also serve as a strong endorsement for the company. By instilling confidence in the market, these investors contribute to the overall success of the IPO. While SEBI regulations ensure fair practices, the role of these financial giants remains important in the Indian capital market. Understanding the dynamics of anchor investor participation is crucial for both investors and companies looking to tap the public markets.

Frequently Asked Questions

Who can be an anchor investor?

Only qualified institutional buyers (QIBs) like mutual funds, insurance companies, pension funds, etc. can be anchor investors.

What happens if the allotment price is higher than the bid price for anchor investors?

They need to pay the additional amount to match the allotment price.

Do anchor investors influence the IPO price?

Yes, these investors can influence the IPO price as their investment indicates market interest.

What is the difference between an anchor investor and a QIB?

All anchor investors are QIBs, but not all QIBs are anchor investors. They are a subset of QIBs with a minimum investment of Rs. 10 crore.

Facebook

Facebook Instagram

Instagram Youtube

Youtube