DERIVATIVES

Table of Contents

ToggleOverview

The stock market is not only confined to buying and selling stocks, instead, it has numerous other options that can help you make good money. One of these options is derivatives. These are the types of securities whose price is determined by an underlying asset. This underlying asset can be any stock, bonds, commodities, or currencies. Price of derivatives experiences changes based on price fluctuations of their underlying assets. Derivatives significantly help traders or investors in making money by placing bets on the future value of the underlying asset.

What are Derivatives?

Derivatives are financial instruments whose values are determined by an underlying asset. These underlying assets can be stocks, commodities, currencies, indices, etc. The core purpose of derivatives is to hedge funds, determine the future movement of the underlying asset, and leverage holdings.

Derivatives are used by investors to safeguard their capital. If someone has bought a stock and aims to see an uptrend in its price then they can buy derivatives of that stock which can benefit them if the stock experiences a downtrend. This derivative can be bought at a premium price offered by brokers. This safeguards their money, if the price doesn’t move according to the prediction, that is uptrend; then the derivative purchased in the opposite direction can balance out their losses to an extent.

Whereas, in current times people are using advanced knowledge of technical analysis to trade in options and make good money out of it. With the help of online brokers and adequate market knowledge traders buy derivatives at premium prices and make good profits out of it.

Understanding Derivatives

Derivatives are financial instruments whose value is based on their underlying asset which can be stock, security, commodity, etc. Derivatives are usually used by investors to hedge their cash investments, apart from this many traders have also started actively trading derivatives or short-term gains. Common underlying assets that have derivatives include stocks, bonds, commodities, currencies, interest rates, and market indexes. Derivatives are used for various purposes, including hedging, speculation, and arbitrage.

Advantages and Disadvantages of Derivatives

Advantages:

- Risk Management: Derivatives allow investors to hedge against their investments to reduce potential losses.

- Leverage: Derivatives give leverage to the trader for holding a larger quantity with a small amount.

- Liquidity: The majority of derivatives are highly liquid, making it easy to enter and exit positions.

- Price Discovery: Derivatives help in contributing to the more price-specific trading for the underlying assets.

Disadvantages:

- Complexity: Derivatives are highly complex and difficult to understand, especially for beginner-level traders and investors.

- Leverage Risk: The brighter side is that leverage amplifies the gains, but the darker side is that it can also amplify losses, leading to significant financial risk.

- Market Risk: Derivatives are highly susceptible to quick market fluctuations and theta decays, increasing the chances of quick losses more than quick gains.

- Regulatory Risk: Changes in regulations of the company policy and government policies can impact the functioning and availability of derivatives markets.

Also Read: Strategies for Options Trading

What Are Some Examples of Derivatives?

- Futures Contracts: It is an agreement to buy or sell the asset the fixed future date

- Options Contracts: These are the derivative contracts, but not the obligation, to buy or sell an asset at a specified price in exchange for a small premium.

- Swaps: These are the agreements to exchange cash flows or other financial instruments between two parties. Some common types of swaps include interest rate swaps and currency swaps. These are only done over the counter.

- Forward Contracts: These are customized contracts between two parties to buy or sell a security at a specified future date for a price agreed upon the day of purchase.

- Credit Default Swaps (CDS): These are the special type of financial derivatives that act as insurance against the default of a borrower.

What Are the Main Benefits and Risks of Derivatives?

Benefits:

- Hedging: Derivatives provide an excellent way to hedge investments against price fluctuations in the underlying asset that is being purchased with cash, reducing the risk of capital vanishing.

- Access to Otherwise Inaccessible Markets: Derivatives trading allows investors to gain exposure to the market securities that would otherwise be difficult to invest in directly.

- Speculation: Derivatives lead investors to speculate on future market directions giving them opuntia to capital on those movements.

- Portfolio Diversification: Derivatives can be used to diversify the holdings, spreading risk across different assets.

Risks:

- Leverage Risk: The use of leverage in derivatives can lead to increased losses, sometimes exceeding the initial investment levels.

- Market Risk: Unexpected market moves can lead to significant losses which can shake the emotional health of the trader.

- Liquidity Risk: Some future and options contracts become difficult to sell in volatile market situations.

- Operational Risk: The complexity of derivatives management, along with the possibility of human error, can lead to operational failures.

Types of Derivatives

There are several types of derivatives that can be purchased or traded in the stock market today, these are:

1. Futures and Forwards:

Unlike stocks, these are purchased in the form of lots. Every stock has a different lot size and its price is determined through the pace of purchase. Futures and forwards are purchased as a contract for underlying assets betting on their future price movements. To understand it better, one buys a future of the stock for a particular price for a particular date when they have technically analyzed its charts. With these, they claim that the price of the purchased stock will be at a certain price by a certain date.

The futures are traded in authorized markets led by stock exchanges and regulated by SEBI. Whereas forwards are traded in On the Counter (OTC) market (known as DABBA TRADING), these markets are not standardized and are not regulated by stock exchanges.

Though the structure of futures and forwards are the same, they have one major difference. A future can be sold anytime before maturity. On the contrary, the forwards can be only sold at their maturity rate.

2. Options:

Options are one of the most traded types of derivatives in the stock market. These are similar to futures as their price is also determined based on their respective underlying assets. Also, options are bought for a specific price known as the strike price for specific dates known as an expiry date. Furthermore, it is not at all mandatory to sell the options on a particular date or price.

There are two types of options named call option (CE) and put option (PE).

Also Read: Strategies for Options Trading

Call Option:

Buying Call Option: A trader buys a call option when they predict the upward movement of stock and sells it when they predict the downward movement of the stock. The options of a stock or underlying asset are bought in lots instead of single stock. A trader pays a premium price to buy lots of the stock and their loss is limited to the premium price paid by them. However, if the price of the stock goes in favor of the trader, they can enjoy unlimited profits.

Selling Call Option: A trader sells the call option when they predict that the price of the stock may go down. It is known as short selling. In this traders sell the option at a high price first and buy at a low price. In the selling of call options, the profit is limited to the strike price. Whereas, the loss incurred can be unlimited if the stock doesn’t move in a favorable direction for the trader.

Put Option:

Buying Put Option: The put option is bought by traders who think the market is going to experience a bearish trend. Traders buy a put option for a certain strike price and at a certain expiry date. After buying the put option, the trader aims for the price of the stock to go down. Buying a put option always has unlimited profits opportunities, whereas, the loss can be limited.

Selling Put Option: The put option is sold by traders who think the market is going to experience a bullish trend. Traders sell a put option for a certain price and at a certain expiry date. After selling the put option the trader aims for the price of stock to go up. Selling a put option always has limited profit opportunities, whereas, the loss can be unlimited.

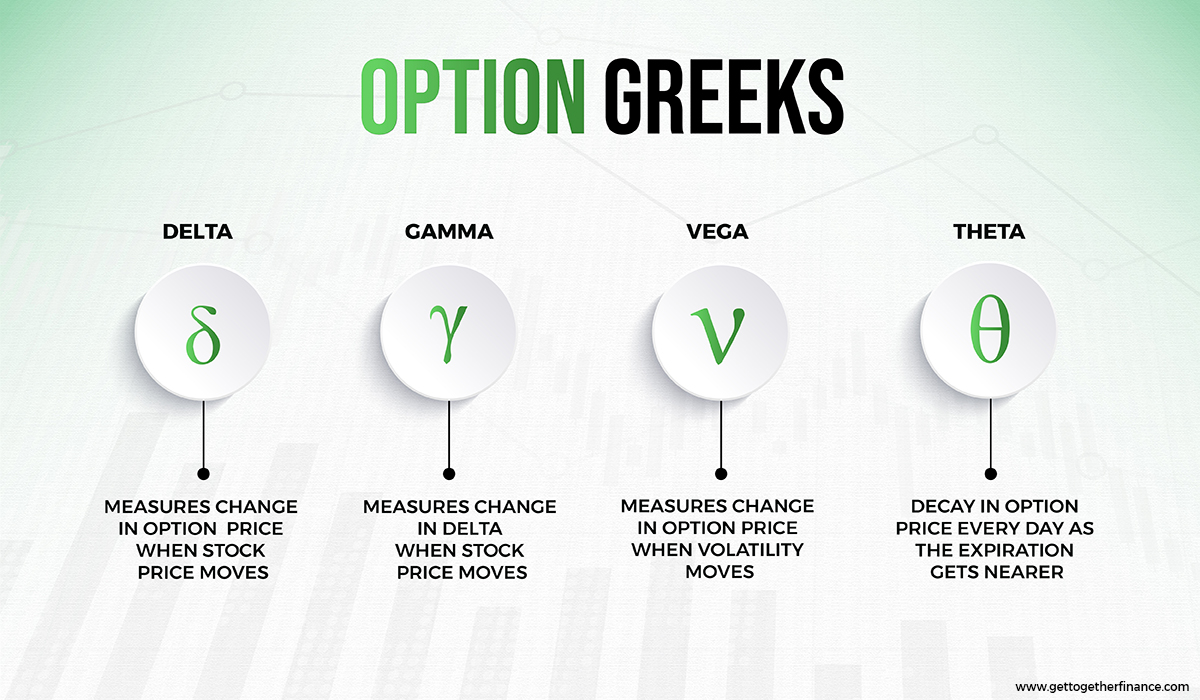

Option Greeks:

Option Greeks are financial tools that help in determining the volatility in option prices. There are several Option Greeks, and studying them can help you analyze the value of options based on an underlying asset. Option Greeks allow us to measure how the price of an option will change based on scrip movement, time passage, volatility, and interest rate. Types of option Greeks are:

1. Delta :-

It helps in determining how much an option price is expected to move for every 1rs change in the stock or underlying asset’s price.

2. Gamma :-

Gamma alters delta as the underlying assets’ movement varies, affecting how much of the movement is participated. Gamma has a dynamic leverage impact by changing the delta when the stock moves in our favor or away from us (greater involvement when right, less participation when wrong).

3. Vega :-

It helps in determining the changes in the Implied Volatility. Unlike delta, Vega focuses on change in expectation for the future regarding the underlying asset.

4. Theta :-

Theta is the time value component for the option derivatives. It helps in understanding that when we have more time to reach the strike price, there are high chances that the strike price could be hit. Whereas, if we have less time to reach the strike price, then the chances of hitting the strike price are low.-

Bottom Line

Derivatives are the financial instrument of the stock market whose value is determined by an underlying asset. Unlike the underlying assets, for example, stock derivatives cannot be bought as a single entity. Instead, we can buy derivatives in lots. There are two core types of derivatives that are majorly traded in the stock market known as futures and options. Investors use derivatives for hedging their funds, this, in turn, safeguards their capital invested in the underlying assets. Though derivatives trading can give you high returns, it is advisable to take the help of well-versed mentors or instructors before stepping into derivatives trading.

CATEGORIES

Facebook

Facebook Instagram

Instagram Youtube

Youtube