DuPont Analysis

Stock market investors prefer safeguarding their capital resources to minting profits, especially during volatile times. As such, they mostly focus on blue-chip stocks. However, to identify and invest in such quality stocks, you must gather multiple financial data of numerous companies for a proper analysis. That includes balance sheets (opening and ending), actual accrual/accrual-adjusted income statements, and cash flow statements.

While performing such an in-depth assessment can get overwhelming, you can turn to the oft-used DuPont analysis to dig deeper into the underlying factors shaping a company’s overall performance.

This piece will walk you through the intricacies of DuPont analysis, exploring its significance, use cases, and drawbacks.

Table of Contents

ToggleWhat Is the DuPont Analysis?

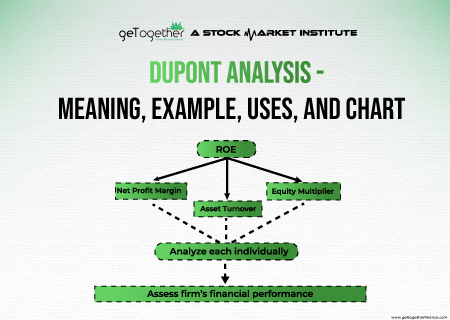

DuPont analysis is a financial ratio that breaks down a company’s return on equity (ROE) into three crucial metrics: profitability, asset turnover, and equity multiplier. That way, investors can separately determine key performance indicators (KPI) and distinguish between the company’s strengths and weaknesses.

DuPont analysis is like the Sherlock Holmes of financial metrics, unraveling the mystery behind a company’s overall performance by examining its various components.

Let’s turn back time.

About a century ago, Frank Donaldson Brown devised a formula that nicely deconstructs a company’s ROE into essential components that offer valuable insights. As Mr. Brown was a member of the American chemical giant DuPont’s Finance Committee, his formula was named DuPont Analysis or DuPont’s Pyramid, or DuPont’s Model.

Fast forward to today, this multi-equation framework has since become a critical tool for financial analysts, investors, and corporate strategists seeking a deep dive into a company’s financial health.

By decomposing ROE into its underlying components, DuPont analysis lets you pinpoint financial activities driving a company’s profitability and make informed decisions about investment, capital structure, and operational efficiency.

Key Components of DuPont Analysis

As mentioned earlier, the DuPont analysis comprises three important ratios:

Net Profit Margin (Profitability)

Net profit margin indicates how efficient an organization is at generating profitable sales. In other words, it depicts how much profit it generates from its revenue. You can calculate a company’s net profit margin using the formula:

[Net profit margin = Net Income/Sales or Revenue (from Operations)]

Where net profit is the cash left over after a firm has paid all its expenses, including taxes and payrolls.

Total Asset Turnover

Total asset turnover (TATO) demonstrates a firm’s efficacy in utilizing its assets to generate sales. Here is the formula to calculate it:

[Total asset turnover = Sales or Revenue/Total Assets]

This financial ratio is inversely proportional to the net profit margin. It helps investors compare a high-profit, low-volume business model of two companies within the same industry.

Equity Multiplier (Financial Leverage)

The equity multiplier measures how much liability and debt a company has taken. Organizations lock in debts from multiple financers – banks, venture capitalists, and bond markets – to fund their operations and corporate goals.

The equity multiplier can be calculated as:

[Equity multiplier = Total Assets/Shareholders’ Equity]

A high equity multiplier denotes that a company has taken a considerable amount of debt to purchase assets and, hence, poses a higher bankruptcy risk.

Also Read: Elliot Wave Theory

DuPont Analysis vs. Return on Equity (ROE)

DuPont analysis and ROE are related concepts in financial analysis, but they differ in their depth and focus.

ROE is a straightforward financial metric representing the percentage return a company generates on its shareholders’ equity. It is a high-level indicator of a firm’s profitability and efficiency in utilizing shareholder funds to increase sales. Mathematically,

[ROE = (Net Income/Shareholders’ Equity)*100]

A high ROE means that a company is clocking an impressive return on its equity, while vice versa indicates that it is not using its equity as optimally as possible.

On the flip side, DuPont analysis is the extended version of ROE. It takes a more granular approach by breaking down ROE into its fundamental components (already discussed). This breakdown offers a more detailed examination of the factors influencing a company’s ROE.

In a nutshell, ROE serves as the headline number, summarizing overall performance, while DuPont analysis is the tool that dissects and explains the story behind that number. Think of ROE as the destination on a map and DuPont analysis as the detailed route, guiding analysts and investors through the intricacies of a company’s profitability, asset management, and financial leverage.

Understanding the DuPont Analysis

The DuPont analysis calculates the ROE in two ways: 3-step and 5-step. Let’s get to the bottom of both the categories.

3-step DuPont Analysis

In the three-point method, the ROE is calculated using the following equation:

[ROE = (Net Profit Margin x Asset Turnover x Equity Multiplier)*100]

Here is an example to understand the formula better by comparing the financial metrics of two similar companies.

| Metrics | Company A | Company B |

| Net Income | ₹1000 | ₹1500 |

| Sales | ₹10000 | ₹12000 |

| Net Profit Margin | 0.1 | 0.125 |

| Total Assets | ₹3000 | ₹4000 |

| Asset Turnover | 3.33 | 3 |

| Equity | ₹2000 | ₹2500 |

| Equity Multiplier | 1.5 | 1.6 |

| ROE | 49.95% | 60% |

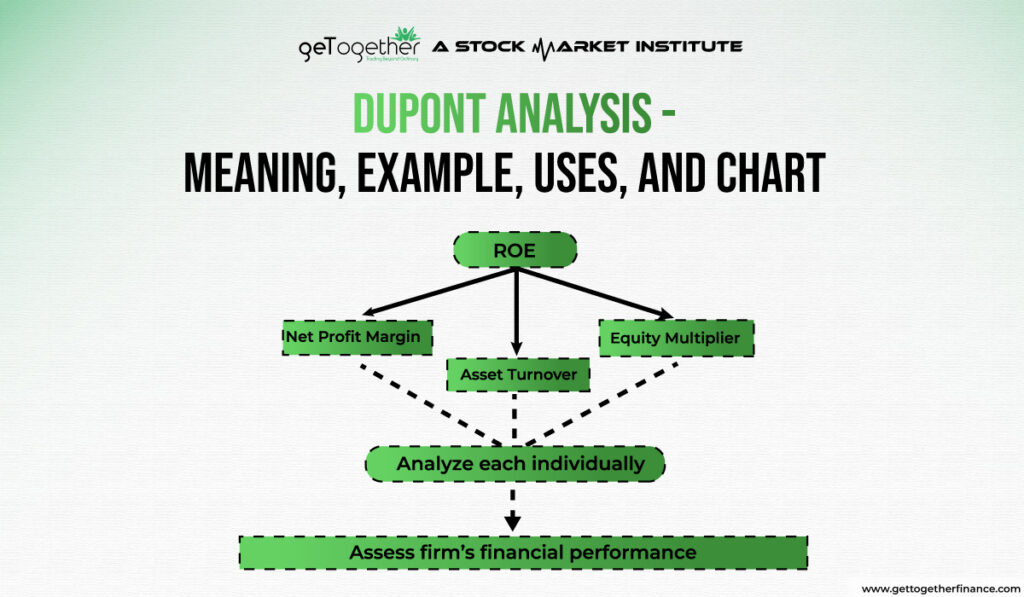

5-step DuPont Analysis

To calculate ROE using the 5-step method, you will need five pieces of information, which are:

- Tax Efficiency = Net Income/Earnings Before Tax (EBT) OR 1 – Tax Rate

- Interest Burden = EBT/Operating Income OR 1 − Interest Expense Ratio

- Operating Margin = Operating Income/Sales

- Asset Turnover = Sales/Average Total Assets

- Equity Multiplier = Average Total Assets/Average Shareholders’ Equity

Combining this information into the final equation, we get:

[ROE = (Tax Efficiency x Interest Burden x Operating Margin x Asset Turnover x Equity Multiplier)*100]

More elaborately,

[ROE = (EBT/Sales) x (Sales/Assets) x (Assets/Equity) x (1 – Tax Rate)]

The 5-step DuPont analysis incorporates two additional components as it further splits the net profit margin into three distinct metrics:

- Tax efficiency: The amount of net income retained after taxes.

- Interest burden: The impact of interest expenses on a company’s profit

- Operating margin: The operating profit (earnings before interest and taxes) retained per dollar of sales minus the operating expenses (OpEx) and cost of goods sold (COGS).

Use Cases of DuPont Analysis

DuPont analysis is a powerful financial tool with versatile applications across various scenarios. Here are some notable use cases:

Performance Evaluation

You can determine whether the company’s performance is primarily owing to efficient operations, effective use of assets, or favorable financial leverage.

Comparison between Companies

When considering investments in a particular industry, DuPont analysis lets you compare the ROEs of various companies in the same industry more comprehensively. It provides insights into companies that are more operationally efficient, better at utilizing assets, and effectively managing their financial leverage.

Risk Assessment

Understanding the components of ROE through DuPont analysis helps you examine the risks associated with your investment. For instance, a company with a high ROE driven by excessive financial leverage could be riskier than one with a similar ROE driven by operational efficiency.

Analyzing Management Efficiency

DuPont analysis serves as a tool to evaluate the effectiveness of a company’s management. For example, suppose a company consistently improves its net profit margin and asset turnover over time. In that case, it means that management is successfully implementing strategies to boost profitability and efficiency.

Predicting Future Performance

With DuPont analysis, you can build multiple scenarios and understand how changes in specific components impact a company’s future ROE. That way, you can make more informed investment-related decisions.

Limitations of Using DuPont Analysis

Despite the DuPont pyramid’s comprehensiveness, it has some drawbacks, including:

Subject to Accounting Methods

The DuPont model banks on financial statements, and the results can be subject to the accounting methods used by a company. Differences in accounting policies, such as depreciation methods or revenue realization, can impact the accuracy and comparability of the ratios.

Assumes Linear Relationships

DuPont analysis assumes that all the ROE components are linearly related. In reality, these relationships may not always be constant or straightforward, especially in dynamic business environments.

Ignores the Timing of Cash Flows

The analysis focuses on accounting measures and may not reflect the timing of cash flows. For example, changes in investment decisions or working capital can impact cash flow but may not be explicitly captured in DuPont analysis.

Limited Insight into Quality of Earnings

While DuPont analysis breaks down ROE, it may not provide a holistic picture of the quality of earnings. For instance, high financial leverage contributing to ROE might indicate increased risk and reliance on debt instead of sustainable operational efficiency.

Not Applicable for All Industries

Some industries have capital structures and business models that do not align well with the assumptions of DuPont analysis. Case in point, financial institutions or capital-intensive industries have different drivers for ROE that are not adequately captured by the traditional components.

Overemphasis on ROE

DuPont analysis focuses heavily on ROE. Even though it is a critical metric, you might overlook other important aspects of a company’s financial health, including liquidity, solvency, and cash flow, by solely depending on this parameter.

Limited Forward-looking Perspective

The analysis is derived from historical financial data and does not offer a robust forward-looking perspective. Changes in industry dynamics, market conditions, or management strategies might not be fully reflected in historical data.

Beyond the Numbers

The beauty of DuPont analysis lies in its precision and attention to detail, enabling you to paint a complete picture of a company’s performance. Whether you are an investor looking for opportunities or a business owner striving for growth, this analytical approach will be your compass in navigating the vast sea of financial data.

That being said, use DuPont analysis in conjunction with other tools and considerations to obtain a 360-degree view of a company’s overall position within its industry.

FAQs

What is DuPont Analysis, and how is it used in financial analysis?

DuPont analysis is a financial technique that breaks down a company’s return on equity (ROE) into three components: profitability, operational efficiency, and financial leverage. It helps investors and analysts understand the sources of a firm’s financial performance by examining the impact of these factors. By doing so, DuPont analysis provides a more detailed and insightful assessment of a company’s overall financial health, aiding investors and analysts in making informed investment decisions.

What is DuPont Analysis, and how is it used in financial analysis?

DuPont analysis is a financial technique that breaks down a company’s return on equity (ROE) into three components: profitability, operational efficiency, and financial leverage. It helps investors and analysts understand the sources of a firm’s financial performance by examining the impact of these factors. By doing so, DuPont analysis provides a more detailed and insightful assessment of a company’s overall financial health, aiding investors and analysts in making informed investment decisions.

What are the key components of DuPont Analysis?

DuPont analysis dissects a company’s return on equity (ROE) into three key components:

Profitability: Examines the net profit margin, indicating how effectively a company converts sales/revenue into profit.

Efficiency: Focuses on asset turnover, revealing how efficiently a company utilizes its resources to generate sales/revenue.

Leverage: Assesses the financial leverage, highlighting the impact of debt on ROE and the company’s overall financial fabric.

How does DuPont Analysis help in assessing a company’s performance?

Here are some ways DuPont analysis helps examine a company’s performance:

Determining the operational and asset use efficiency

Determining financial activities that mainly influence ROE

Checking a company’s management efficiency

Comparing the operational efficiency of similar firms

Checking whether a company’s ROE is lower as it is deemed riskier to invest in

Examining a company’s expenses and its effect on operating profit margin

What is the significance of the profit margin component in DuPont Analysis?

The profit margin component is critical as it examines a company’s ability to turn sales into profits. A high profit margin means the company can mint significant profits per every dollar of sales. This is a favorable sign for shareholders as the company will likely remain afloat over the long term.

How does asset turnover factor into DuPont Analysis?

Asset turnover represents how efficiently a company is leveraging its resources to register sales. A higher asset turnover ratio suggests optimal asset utilization, ensuring a positive ROE for shareholders.

What does the equity multiplier represent in DuPont Analysis?

The equity multiplier reveals how much debt a company is using to finance its operations. A higher equity multiplier indicates that a company is using more debt, which can be risky as it makes it susceptible to economic downturns and interest rate hikes.

Why is DuPont Analysis considered a comprehensive financial tool?

DuPont analysis goes beyond the surface-level assessment of financial performance, offering a deeper insight into a company’s strengths and weaknesses. It delves into finer details of profitability, efficiency, and financial leverage. Understanding these crucial ROE components helps investors better understand how a company is generating its profits. They can use this information to identify companies that are well-managed and likely to generate good returns in the future.

How can DuPont Analysis be applied to compare two or more companies?

You can apply DuPont analysis to compare the key growth drivers of various similar companies. After calculating ROE ratios, you can identify areas where one company is outperforming another. Moreover, you can monitor the financial performances of multiple firms over a certain period and compare the results for more accurate investment decisions.

Facebook

Facebook Instagram

Instagram Youtube

Youtube