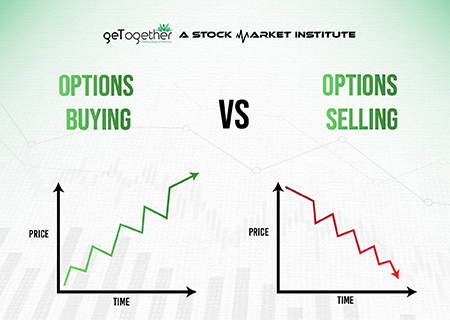

OPTIONS BUYING VS OPTIONS SELLING

As an option trader two ways for trading an options

One is option buying and another one is option selling, but the question is when to be buyer and when to be seller? In this article you will get to know which one is better.

A basic difference before we start, buying an option contract is like buying an insurance policy for that we have to pay some premium and on other hand selling an option contract is like selling an insurance policy (insurance company) which collect the premium which we have paid.

Table of Contents

ToggleRISK CORRELATIONS

When you are LONG options,

The most you can lose is the premium you paid. Therefore …..

RISK is LIMITED and REWARD is UNLIMITED

When you are short options,

The most you can make is the premium you took in. therefore….

REWARD is LIMITED and RISK is UNLIMITED

IN SIMPLE LANGUAGE WE ARE INSURED IF BUY OPTION AND WE ARE INSURER IF WE ARE SELLING OPTIONS

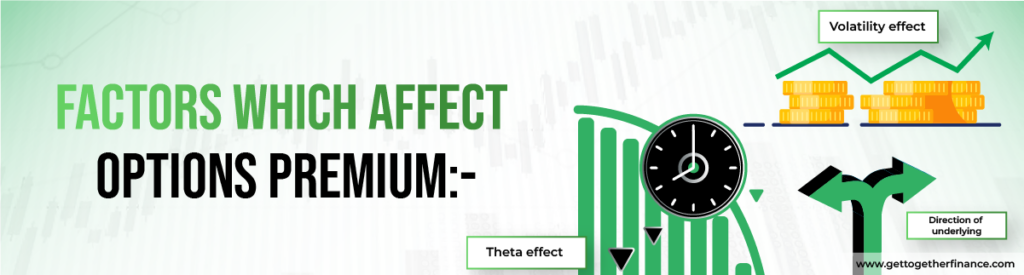

Factors which affect options premium:-

The major factor which affect option premium are Time decay (theta), volatility (vega), and underlying direction (delta)

Theta effect:-

Options buyer- enemy

Options seller- friend

An option with more time to expire is more valuable. However, the option price becomes less valuable each day since the probability of reaching at strike price decreases daily – beneficial for the option seller.

Also Read: Theta Effect for Option Buying

Volatility effect:-

volatility factors measure whether the people are in calm mode or in panic mode, whenever there is a quarterly result or any event related that particular stock, people come in panic mode and its causes the higher implied volatility as compared to historical volatility.

An option price is expensive when implied volatility is high.

An option price is cheap when implied volatility is low.

So things that should be keep in mind is that IV (implied volatility) should be lower when we are planning to buy an option and should be high when we are planning to sell an options.

Direction of underlying:-

we take a position generally based on whether we are bullish or bearish, so if we right in direction this will help for both options buyer and seller and if we are wrong in direction than this will hurt both options buyer and seller, but we know option premium can be max go to “zero” for option buyer but for seller it can go the infinity level and it may hurt more when particular option go for IN-THE-MONEY.

So direction also play an important role.

Understanding Options Risks

The stock market is full of opportunities, but as many opportunities it holds, there are an equal number of risks involved. Risks and opportunities go hand in hand here. Still, there is no shortage of risk-takers and profit-makers in the market.

In the stock market, one of the riskiest types of trading is options trading. The quick ups and downs can make or break your money. Options trading allows you to buy multiple lots of shares by paying a minimal premium till a certain expiry date. However, the premium price fluctuates based on the intensity of buying and selling done in the underlying asset or the stock.

Most of the time, the options premium becomes zero when the expiry is near. One needs to study the market very well to make profits before the expiry.

There are two types of options; call option and put option. Both of these have buying and selling options. Somewhere, the risk is limited to a certain price band, whereas somewhere risk is limitless.

Both call and put options have their own set of risks and rewards, you need to have advanced knowledge about technical analysis. Risk is involved when you don’t know the direction the price is going to move and still bet your money on it.

Risk Evaluation When Buying Options

Buying options requires minimal premium compared to selling options. Eventually, the premium of buy options is going to get zero as the expiry date comes near. To make profits by buying options you need to study the candlestick chart thoroughly along with implied volatility to get a sure shot about when the favorable movement is about to come. Here’s how buying in call and put options work:

- Call Options: Buying call options signifies that you are being bullish on the market. In the simplest language, you aim for the stock to reach the strike price you have bought. If the stock doesn’t go in an upward direction after buying, the premium will eventually fall, leading to a loss in price.

- Put Option: Buying put options signifies that you are being bearish in the market. You aim for the stock to not reach the strike price you have bought. The more the stock price goes away from your strike price, the more the premium increases. If the stock doesn’t go in a downward direction after buying, the premium will eventually fall, leading to a loss in price.

When you buy options your profits can be unlimited, but the loss is only limited to the premium you paid. So here, risk can be easily calculated before entering into the position.

Risk Evaluation When Selling Options

Selling options require more money compared to buying options. Here, the premium is quite high. When you sell the option, you aim for the premium to become zero. As low as the premium gets after selling the option, your profits increase. Here’s how selling put and call options work:

- Call Options: Selling call options signifies that you are going bearish in the market. As the price of stock goes down, your premium will decrease, resulting in profits.

- Put Options: Selling put options signifies that you are going bullish in the market. As the price of stock goes up, your premium will decrease, resulting in profits.

When you sell options your profits become limited. The bandwidth of profits is between the current price of an option to the point it becomes zero. However the loss cannot be calculated, as there is no limit to where the premium can rise. So here, risk cannot be easily calculated before entering into the position.

Pros and Cons of Buying Options

As said earlier, securities in the stock market have their own set of risks and rewards. In options trading. Surely the risks are greater than the rewards, but that doesn’t mean people don’t enjoy rewards. The risks can be easily managed with in-depth technical analysis. Both pros and cons are part of the stock market. Here are the pros and cons of buying options:

PROS

- Loss is limited: Only the premium you paid is subjected to the loss

- Smaller commitments: Extremely minimal premium allows you to buy multiple lots of shares. A smaller commitment can lead to higher profits if managed and studied well.

- Excellent Hedging Option for Bearish Traders: There are times when you enter into a short position expecting the stock to move downside. Here, if the position is of a hefty amount, you protect the losses by buying the call option for the same stock. In case, if stock goes in an unfavorable direction, the losses will be compensated by the profits of the call option. Not fully, but to an extent.

CONS

- Entire Premium can be lost: You can lose the entire premium if the stock does not go in a favorable direction. Even if the stock doesn’t move at all, the time decay will make the premium zero. Hence, there are very minimal chances of profits if you don’t enter the position by analyzing the stock well.

- Time decay can be dangerous: If the stock price keeps consolidating in the same price range for a longer period of time. Not moving in either direction. The premium will automatically decrease, leading to losses for buyers.

Pros and Cons of Selling Options

Selling Options come with a set of risks and rewards, but the risks are comparatively low compared to buying options. The premium price may be higher, but the risk of losing it all is certainly lower. Here’s how selling options function:

PROS

- Time Decay is a Friend: Here, time decay can be a friend to you unlike buying options. If the stock keeps consolidating in the same range for a long time, the time decay will automatically decrease the options premium. And when you sell options, all you want is the premium to fall.

- Risk is lower: There are higher chances of the options premium becoming zero as the expiry date comes near. So, options sellers are mostly in profit.

CONS

- Higher Premium: The premium required to sell the options is comparatively higher than the premium required to buy options. Not many people can easily afford it.

- Loss cannot be measured: If the price of the stock goes in an unfavorable direction, leading to an increase in premium, the loss can be immeasurable. Here, the risk is surely limitless.

Is Buying vs. Selling Options Right for You?

There is no set answer to this question. Buying and selling options should be decided when you have gained enough knowledge about options trading. There are opportunities for everything in the market, you need to be educated enough to understand and grab the opportunities.

Buying and selling should be decided based on the study of the stock.

In general, buying options is less risky when we look at it from the premium perspective. The premium is very low and if the stock goes in a favorable direction then the profits can be unlimited.

But, when we see mere consolidation hope in the stock, selling options can be a beneficial idea. Eventually, the time decay is going to make the option price zero, leading to profits for you.

Selling An Option or Shorting a Stock: How Are They Different?

Selling an option and shorting a stock are two different things. Selling can be done for both, bearish and bullish views. Whereas shorting a stock is always done with a bearish view, here, you always expect a stock to fall.

Whereas, when you sell a call option, you expect a bearish movement in the stock, in the case of selling a put option, you expect an up move in the stock price.

Also, unlike the short trading option, the sell option can be carried forward till the date of expiry. In the short-selling of cash trade in stocks, only intraday positions can be taken.

Can You Combine Buying and Selling Options?

Yes, one can surely combine buying and selling options, this unique strategy is called option spreads. Here, the traders simultaneously buy and sell options of different strike prices to benefit from small market movements. The risk is lowered with different positions. Also, on either side, a favorable movement can be easily caught.

The bull spread, in which an investor buys a call option at a lower strike price and sells a call option at a higher strike price, is a popular spread. The bear spread, on the other hand, entails purchasing a put option with a higher strike price and selling a put option with a lower strike price, projecting a price fall.

These tactics enable traders to control risk and profit from changing market conditions.

SUMMARY:-

when we are buying an option we can control only two factors which are volatility & directions but we can’t fully control the time decay effect, however some certain conditions through which we can reduce the time decay effect(theta).

While selling an option we can control all these three conditions. So option selling is much better than option buying. Even if we are planning to buy an option make sure that the underlying behaves very fast in the same direction that we have planned (very much confident in direction) so it can have some intrinsic value and can reduce the time decay effect.

FAQ:-

What is the fundamental difference between buying and selling options?

When you buy the option, you aim for the premium to rise by going in a favorable direction. In the call option, the favorable movement is upwards whereas in the put option favorable movement is downwards.

When you sell the option, you aim for the premium to fall by going in a favorable direction. In the call option, the favorable direction is a fall in price. Whereas, in the put option favorable direction is an up move in price.

What are the primary risks associated with buying options?

The key risks of buying options include the possibility of losing the full premium price if the option expires without giving a favorable movement, time decay reducing the option’s value as it approaches expiration, and the risk of the underlying asset not moving favorably within the option’s duration, resulting in no profit.

How do selling options differ from buying options in terms of strategy?

Selling options involve longing for the option premium to fall. Here you first sell the option at a higher price and then buy it again when it falls. Simple buy low and sell high.

Can you explain the concept of time decay and how it affects option buyers and sellers differently?

The decrease of an option premium’s value as it approaches expiration is described by time decay, also known as theta decay. It has distinct effects on option buyers and sellers. Time decay reduces an option’s value, causing its price to fall as expiration approaches. This decline accelerates as the option approaches expiration, potentially resulting in a total loss of the premium paid if the stock doesn’t move in a favorable direction. Time decay, on the other hand, benefits option sellers because it reduces the option’s value over time. Sellers profit from the decrease in the option’s value, especially if the option expires worthless, allowing them to grab maximum gains.

What are the advantages of buying options over selling options, and vice versa?

Buying options has a low risk (the premium paid) and possibly unlimited profits if the underlying asset moves in a favorable direction. It enables traders to profit from market fluctuations without committing to ownership. Selling options, on the other hand, provides cash through premiums but has a larger risk, including the possibility of limitless losses in some situations. Time decay and market stability benefit sellers, but the possibility of severe losses needs top-notch risk management.

How does the direction of the underlying asset’s price movement impact the profitability of option buying and selling?

The direction of the underlying asset’s price movement has a significant impact on the profitability of option buying and selling. Option buyers profit from the asset’s expected movement—call buyers profit from price increases, while put buyers profit from price drops. Option sellers, on the other hand, make profit when the asset price remains stable or moves in the opposite direction of the buyer. Sellers profit from stability or modest changes, hoping for options to expire worthless with a time decay effect.

Are there specific market conditions or strategies that favor options buying or options selling?

Market conditions frequently favor either option buying or selling. Volatile markets tend to benefit option buyers by providing more dramatic price changes, anticipating that the option will become profitable. In contrast, options sellers who benefit from time decay and prefer options to expire worthless generally benefit from stable or consolidating markets. Buyers may seek momentum, while sellers may capitalize on stability, depending on market volatility.

What are some common misconceptions about options buying and selling?

Many people assume that buying options is riskier because the entire premium can be lost. However, both purchasing and selling options carry risks that must be carefully considered.

Some people believe that selling options has a limited profit potential because they receive premiums. In reality, in certain instances, sellers may risk endless losses.

Options are frequently regarded as extremely complex and risky elements of the stock market. While they have complexities, learning in-depth techniques can assist in properly navigating their use.

How can investors use options buying and selling to manage risk in their portfolios?

Options for risk management in portfolios can be used by investors by adopting techniques such as protective puts to hedge against hefty investments, trading individually for extra income, or using spreads to reduce possible losses. In volatile markets, these tactics serve to reduce risk exposure and provide downside protection.

Can you provide examples of successful options buying and selling strategies in different market situations?

In a bullish market, a good options buying strategy is acquiring call options to profit on price increases. Selling covered calls creates income in a down market. Purchasing protective put options in a down market helps to limit negative risk. These techniques are designed to maximize returns by aligning with market conditions.

CATEGORIES

Facebook

Facebook Instagram

Instagram Youtube

Youtube