What is Market Capitalization in the stock market?

Whenever we hear about a company’s valuation we always think that the name of certain companies are involved unnecessarily as they are not big enough to be considered, but we forget the wisest line someone said: “It’s not that company isn’t successful, it just isn’t successful enough to justify all the money investors have pumped into it.” So how do investors know which is the suitable company to invest in? Market capitalization is one of the most effective ways of assessing a company’s value. This evaluation of the publicly traded company is done based on the company’s stocks.

The market capitalization of the company can guide investors to choose the right share to invest in. By understanding the value and risk associated with the company investors can make a balanced investment that can be distributed among stocks of different companies. In this Blog, we will explore what market capitalization is, its types, and the factors that affect the market capitalization of the company.

Table of Contents

ToggleUnderstanding market capitalization

Market capitalization is one the most important characteristics that help the investor to determine the returns and the risk in the particular share. In simple words, market capitalization is the aggregate valuation of the company based on its current share price and the total number of outstanding stocks. Furthermore, the investors choose the stock that can match their 2R strategy i.e. risk and reward strategy.

How can investors calculate Market Capitalization?

The calculation of the market capitalization is relatively straightforward. It is determined by multiplying the current market price per share by the total number of outstanding shares. Hence, the formula for market cap can be expressed as:

Market Capitalization = Current Market Price per Share × Total Outstanding Shares.

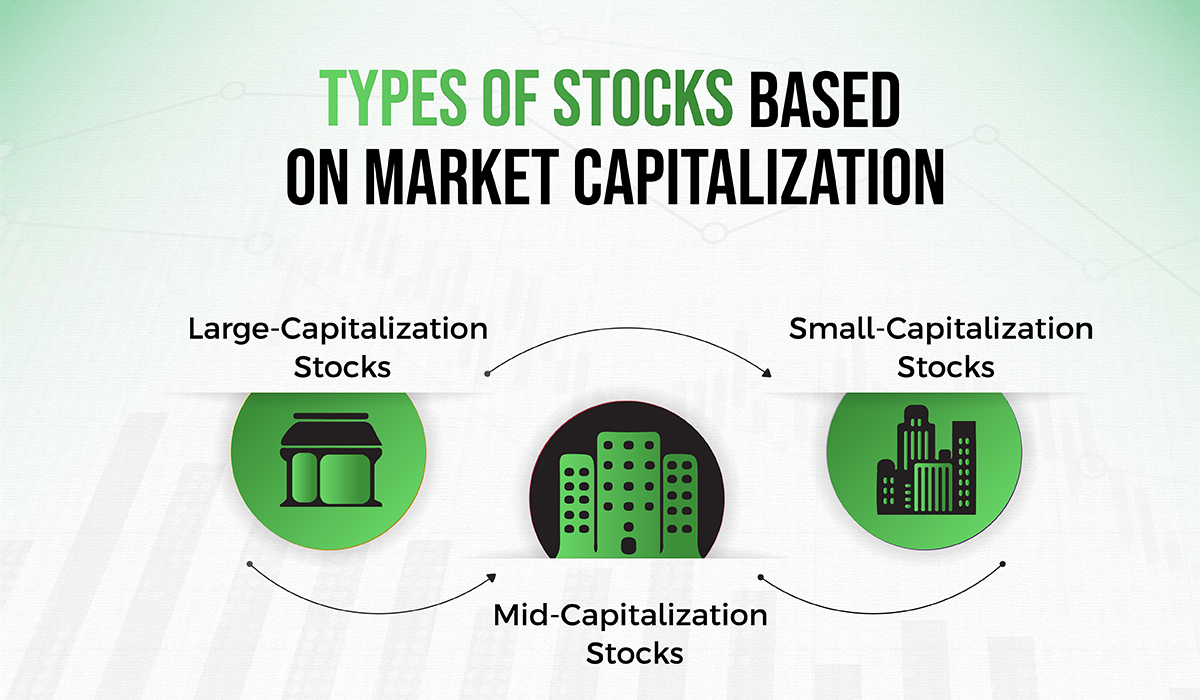

Types of stocks based on Market Capitalization

Large-Capitalization stocks:

Large-cap companies are often well-established companies i.e. they are the leading in their respective sectors. Conventional investors who are seeking stable returns and dividend payments specifically, go for large-cap stocks. Large-capitalization stocks generally display lower volatility compared to smaller companies. Due to their size and stability, large-cap stocks generally show more stability compared to small-cap stocks. Furthermore, They are less affected by market fluctuations and economic downturns, which makes them a safer investment option for risk-averse investors.

Institutional investors who are involved in pension funds and mutual funds are generally more attracted by large-capitalization companies, as these institutional investors have considerable resources of the company and they do conduct extensive research in order to make secure investment decisions. Hence, their interest in large-capitalization stocks can provide a sense of stability and credibility to individual investors.

Disadvantages of Large-Capitalization stocks

1. Slower growth potential

Large-capitalization stocks, being well-established companies, may experience slower growth rates compared to smaller companies with higher growth potential. The size of these companies makes it challenging to sustain high growth rates consistently.

2. Limited room for the significant price increase

Large-capitalization stocks are already from stable companies that have significant market valuations so it becomes very challenging for investors to earn major profits from it. Investors seeking substantial capital gains might find limited opportunities within large-capitalization stocks.

Mid-Capitalization Stocks:

Mid-capitalization stock companies often have a higher growth potential than large-cap stocks while still offering a certain level of stability. These stocks offer a balance between large and small-capitalization stocks in terms of risk and growth potential. Moreover, these companies have already experienced some level of growth and achieved a certain market position so they provide opportunities for investors seeking a mix of stability and growth potential. These stocks usually offer attractive investment opportunities as they may be pushed for further expansion and market recognition. Identifying mid-capitalization stocks with strong fundamentals and growth prospects can lead to rewarding investments for investors.

Disadvantages of Mid-Capitalization Stocks

1. Mild liquidity and trading volume

Though mid-capitalization stocks generally have better liquidity than small-capitalization stocks, they may still experience moderate levels of illiquidity and trading volume. While executing a trade investors should be aware of the potential challenges, particularly during periods of market volatility.

2. Mixed interest

Mid-capitalization stocks receive varying levels of institutional investor interest. Some institutional investors may actively seek opportunities within the mid-capitalization segment, while others may have specific preferences or limitations that affect their investment decisions. This mixed interest can influence the overall market dynamics of mid-capitalization stocks.

Small-Capitalization Stocks

Small-capitalization stock companies tend to be underdeveloped, having higher growth prospects that may operate in hollow markets. Small-capitalization stocks carry higher risks due to their size, but they can also provide substantial returns for investors with proper knowledge and research. Small-capitalization stocks, being in the early stages of growth, often have higher growth potential compared to larger, more mature companies. These companies can experience rapid expansion and value upgradation if they successfully execute their business strategies. In the domain of small-capitalization stocks, active investors have the opportunity to discover undervalued stocks which are also known as hidden stocks, these are not yet discovered by the broader market that can offer significant returns if their true potential is realized.

Also Read: Nifty Midcap Index

Disadvantages of Small-Capitalization stocks

1. Higher volatility and risk

Investing in small-capitalization stocks involves a higher level of risk. These stocks can be more responsive to market fluctuations and economic uncertainties in comparison to large-cap and mid-cap stocks which makes them riskier investment options.

2. Limited institutional investor interest

Small-capitalization stocks often receive less attention from institutional investors compared to their larger counterparts. Institutional investors may have restrictions or preferences that prevent them from investing in smaller companies. This limited interest can impact the stock’s liquidity and overall market performance.

Factors Affecting Market Capitalization

1. Industry and Market Conditions

The dynamics of the industry in which a company operates and the overall market conditions can affect its market cap. Factors such as industry growth rate, competitive landscape, market trends, and consumer demand influence investors’ expectations and trust in the company’s future prospects. The industry’s positive outlook and favorable market conditions generally contribute to higher market capitalization.

2. Regulatory Environment

Regulatory factors, including government policies, industry regulations, and compliance requirements, can influence market cap. Changes in regulations or legal issues faced by a company may impact its operations, goodwill, financial performance, and investor faith, thereby affecting market capitalization.

3. Management and Leadership

The competence and track record of a company’s management team and leadership play a crucial role in determining market cap. Investor confidence is influenced by the management’s ability to make sound strategic decisions, execute business plans, and navigate growth. Strong and visionary leadership often leads to higher market capitalization.

4. Economic factors

Market Capitalization can definitely be affected by Economic Factors as it includes GDP growth, inflation rates, interest rates, and unemployment rates. Financial steadiness and great macroeconomic circumstances establish a favorable climate for business development, attracting traders and driving up market capitalization. On the other hand, financial steadiness or vulnerabilities might stimulate a decrease in the market cap of the company.

5. Advancement and Innovation

The capacity of an organization to enhance and adjust to mechanical improvements is a significant consideration for market caps. Companies that show dedication to research and development, possess intellectual property, and utilize technology to gain an advantage over competitors are valued more by investors. Organizations at the very front of advancement frequently appreciate higher market caps.

Conclusion

Market capitalization is a basic idea in the stock market that is very important when making decisions about investments. Enormous cap stocks give security and liquidity yet may have restricted development potential. Some stocks have a higher potential for growth, but they also come with more risk and volatility, some stocks find some kind of connection between stability and growth of the company. You can strategically divide your investments among various market capitalizations to create a diversified and optimized portfolio by considering your risk tolerance, financial objectives, and time horizon.

FAQs

1. What role does market capitalization play in investing?

Market cap is critical in effective money management as it assists traders with observing the size, worth, and capability of an organization. It provides a foundation for developing investment strategies and understanding a company’s market position.

2. How does market capitalization influence stock liquidity?

Stocks with bigger market caps will quite often have higher liquidity, as there are more buyers and sellers in the market. Investors can buy or sell shares with less of an impact on the stock’s price because of this increased liquidity.

3. Can market capitalization change over time?

Market caps can indeed fluctuate over time. It varies in light of the stock value developments and changes in the number of remarkable offers. The market caps of a company will change with its stock price and/or the number of outstanding shares.

4. How is the market capitalization of a company typically calculated?

Multiplying the total number of outstanding shares by the current market price per share is the most common method for calculating market cap. This calculation offers the all-out benefit of the organization as seen by the market.

5. How does a company’s market capitalization affect its capacity to raise capital?

It can influence an organization’s capacity to raise capital. Because they may have more significant assets and a higher credit rating, businesses that have higher market caps frequently have an advantage when it comes to gaining access to capital markets. They may find it simpler to issue new shares or raise money through debt offerings as a result of this.

CATEGORIES

Facebook

Facebook Instagram

Instagram Youtube

Youtube