WORKING CAPITAL

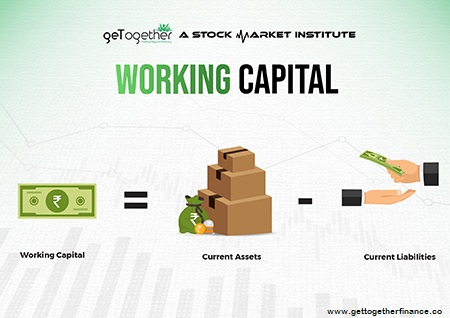

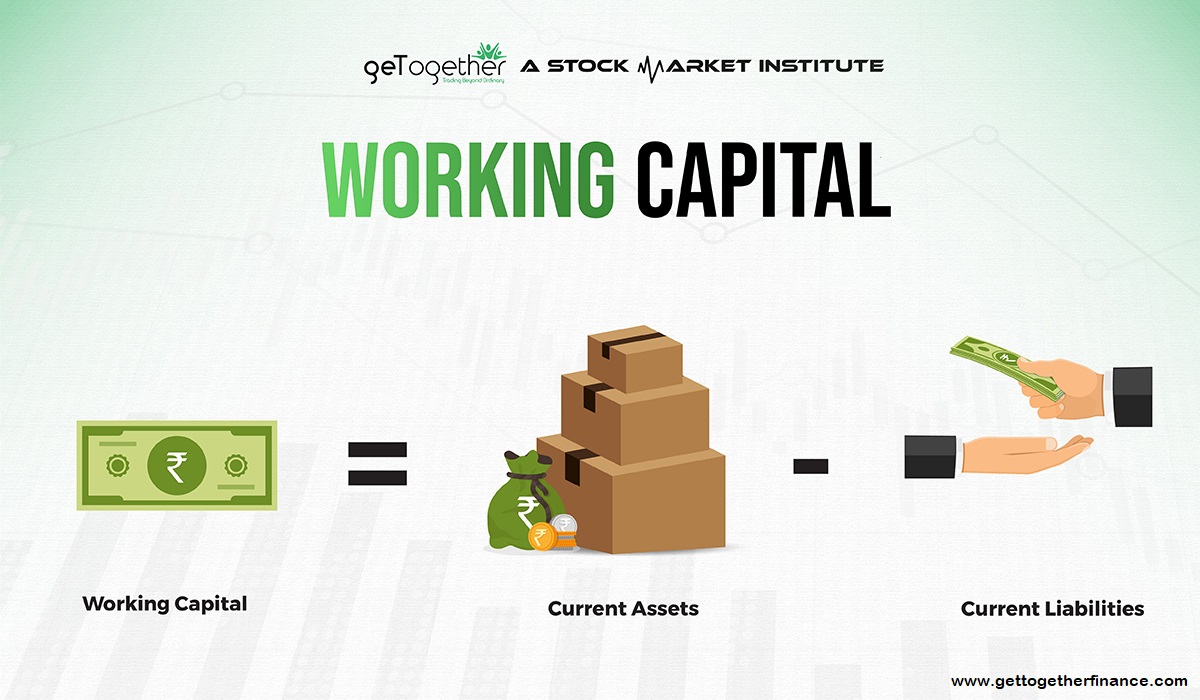

When you choose to invest your money in the stock market, you choose to invest in the company. You trust the company that it is going to utilize your money in a good way and give you returns on it. When you analyze a company for investment, one of the things that are important to check is its working-capital. The working-capital of a company is the difference between current assets and current liabilities. It is the capital that a business utilizes to fuel its day-to-day operations. It is used to gauge a company’s financial health and liquidity, enabling it to meet its current responsibilities and pursue new opportunities.

Let’s dive into the blog and start a journey to understand working-capital, its significance, its types, and its impact on investors.

What is Working Capital?

Working-capital is the money or capital that a company utilizes to run its day-to-day operations. It is the capital that the company uses to run the business seamlessly and generate more profits.

Every company must have an adequate amount of money to sustain its day-to-day operations and meet its immediate financial requirements. These financial requirements often include staff wages, rent, trite bills, and so on. A company should have a decent amount of money to maintain a positive working-capital. It ensures investors that it can take care of its liabilities well. Investors calculate all this by subtracting the company’s current liabilities from current assets.

Here’s how decent working-capital is significant for every company:

1. Easy Working:-

If the company has adequate working-capital, its operations tend to be seamless and profitable. It allows the company to meet its responsibilities and avoid uncertainties.

2. Emergency Fund:-

Working-capital which is also known as an emergency fund. It acts as a protector to balance the losses in unforeseen events, economic downturns, or unexpected expenses.

3. Flexibility:-

Having a strong working-capital position allows the company to be flexible in its operations. Further, it gives the company the advantage to take up new opportunities for expanding its business.

How to calculate working capital

In total, there are 5 types of working capital, here are how they are calculated:

- Working Capital= Current Assets – Current Liabilities

- Net Working Capital= Current Assets (Minus Cash) – Current Liabilities (Minus Debt)

- Operating Working Capital= Current Assets – Non-Working Current Assets

- Non-Cash Working Capital= Current Assets (Minus Cash) – Current Liabilities

- Change in Working Capital= Working Capital (Current year) – Working Capital (Previous year)

Reasons why your business might require additional working capital

Businesses require additional working capital to keep growing and expanding to give their customers and investors the full value of their money. Here are the circumstance that is utterly required:

- Growth: Rapid expansion decisions require extra capital to fund the new operations and streamline the growth process.

- Seasonal Fluctuations: Businesses whose working shoots up in certain seasons need to adjust their working capital accordingly in the peak season to meet the increased demand of the customers and clients.

- To Hire Extra Workforce: Sometimes the companies hire temporary employees to fulfill certain project requirements, in these circumstances, additional working capital is significantly required.

- Equipment Requirement: Sometimes, the manufacturing firms may need urgent equipment installment, this mandates the need for additional working capital.

Advantages of working capital

As studied easter, working capital helps in fueling the day-to-day business operations, from spending to saving money, everything can be managed by improved working capital. Here’s how it helps businesses:

- Operational management: The management of inventory and day-to-day operations is seamlessly carried out by improved working capital.

- Improves financial health: The day-to-day expenses and short-term obligations are easily met with good working capital. Payment to suppliers, vendors, and the government, can be done without waiting for the payment from customers.

- Good credit score: A good credit score can be achieved by companies if they maintain consistent working capital, making it easy for them to get loans.

Limitation of working capital management project

Though working capital can help in gauging the financial performance of the company, it cannot be taken as the sole indicator for studying the financial health of the company. Here’s where working capital lacks:

- Overlooks long-term obligations: Working capital only considers short-term obligations and gives the overview of settling them off only. Long-term debt is completely ignored here.

- Business environments are unpredictable: Sudden events can impact the working conditions of businesses in any sector. In crucial times like this, the information of working capital fails, it is of no use to investors. All that matters is how well the business policies are accurate in tackling crises and increasing revenue.

- Does not Guarantee Profits: Although efficient working capital can assist in avoiding financial issues, it does not ensure a high profit. Things do not instantly become more attractive or boost a company’s position in the market. To enhance profits, businesses should concentrate on techniques such as growing sales, controlling costs, and other activities. Because these programs improve the bottom line, effective capital management can help a firm grow and reinforce its position.

What are the types of Working Capital?

Working-capital has various aspects and helps investors in making informed decisions. Working-capital is of different types depending upon periodicity and concept. Types of working-capital are:

Gross Working Capital:

It only shows the current assets of the company, that can be converted into cash within a year.

Permanent working capital:

Permanent working-capital refers to the minimum level of current assets that a company needs to meet its day-to-day operations. Usually, permanent working-capital doesn’t get affected by seasonal fluctuations as it may include staff wages, rents, and so on.

Temporary or seasonal working capital:

It is also known as seasonal working-capital and serves as an additional working-capital. It is mainly needed to meet the short-term demands of the company. These demands arise due to specific seasons or periods of increased business activity.

Net Working Capital:

It is simply the difference between the current assets and current liabilities of the company. It shows the amount of capital a company has to carry out its day-to-day operations.

Reserve Margin Working Capital:

It is the capital the company has reserved for uncertain circumstances. These can be natural calamities or disasters or industrial strikes.

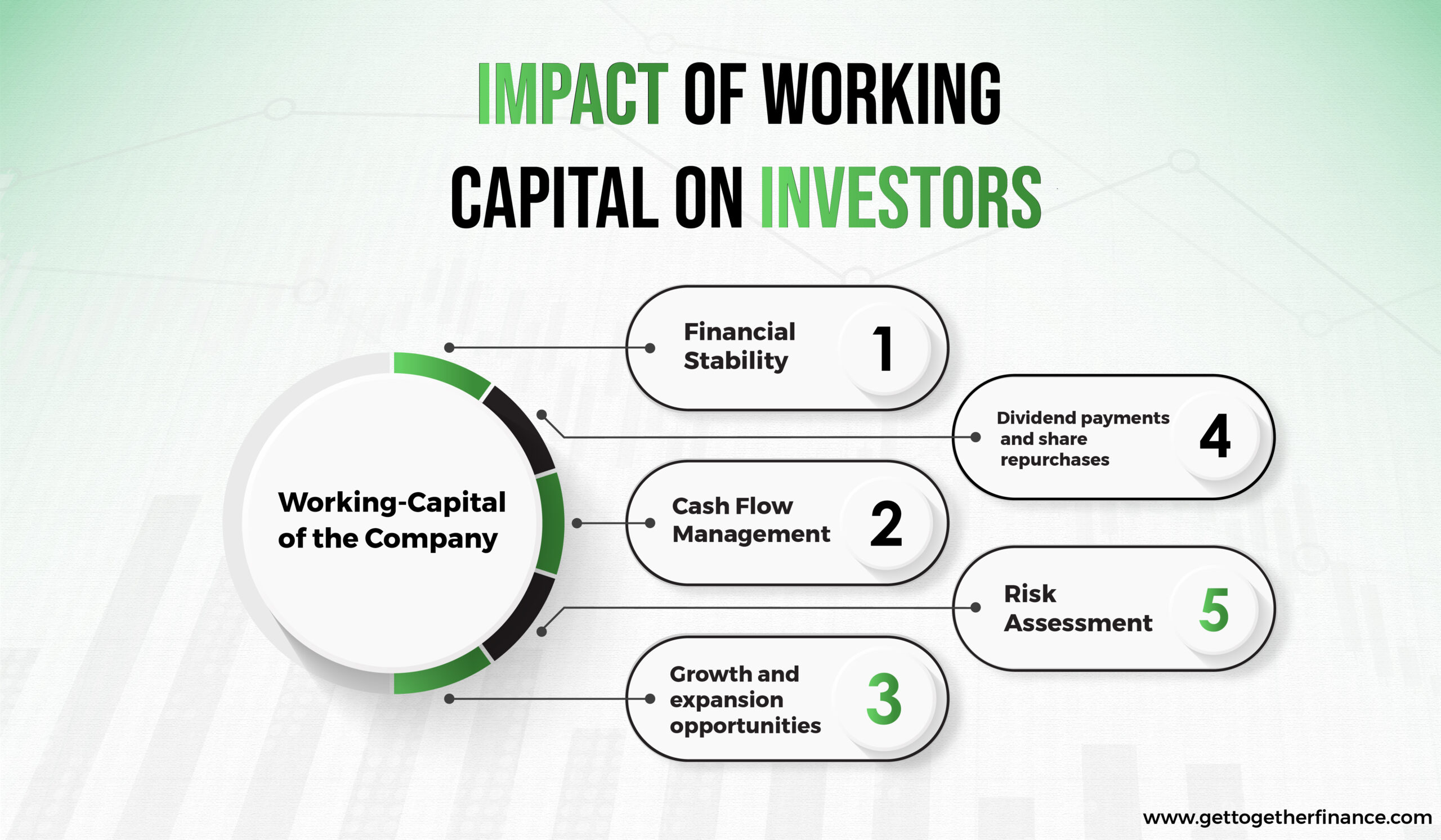

IMPACT OF WORKING CAPITAL ON INVESTORS

Investors’ decisions are heavily impacted by the working-capital of the company. Working-capital helps in assessing a company’s financial strength. Investors tend not to put their money in a company that is not financially stable. This is because it doesn’t give them an idea of whether their money will be utilised well. Below mentioned are some reasons how working-capital impacts investors’ decisions:

1. Financial Stability:

Companies that have positive working-capital portray a financially stable future. This signals the safety of money for investors.

2. Cash Flow Management:

Working-capital of a company directly affects a company’s cash flow. Investors generally look for companies with adequate cash flow as it signifies a strong and reliable financial strength.

3. Growth and Expansion Opportunities:

Sufficient working-capital provides companies with the flexibility to grow and invest in better opportunities. This is possible because the company has a significant amount of money to risk. It leverages them in launching new products or acquiring competitors.

4. Dividend Payments and Share Repurchases:

If a company has good earnings, it shares its earnings with its investors in the form of dividends. Hence, investors prefer a company with strong working-capital as it is bound to generate good profits. When investors choose a stock with a good dividend, it acts as a passive income for them.

5. Risk Assessment:

Working-capital is a vital indicator of a company’s risk profile. As negative working-capital increases concerns about the company’s ability to complete short-term obligations. Thus, increasing the risk for investors.

Conclusion

With the above discussion, it can be understood that working-capital serves as the financial lifeblood of the company. It ensures that the company has funds for its daily operations and overall growth. Striking the correct balance between current assets and liabilities is essential for maintaining financial stability and seizing expansion opportunities. By understanding the significance of working-capital and effectively managing it, companies can strengthen their position in the market. Further, the company can start on the journey toward sustained success.

FAQs

1. What happens if a company has low working capital?

Low working capital indicates that a company’s current liabilities exceed its current assets. While this might not be immediately alarming for certain industries, it can pose significant risks. It can create difficulties in paying debts or meeting short-term obligations.

2. Can a company have too much working capital?

Having too much working capital might signify inadequate use of resources. While it ensures liquidity, it might also indicate that the company is not investing its excess funds optimally.

3. How frequently should a company assess its working capital?

Regular assessment of working capital is vital, especially during dynamic market conditions. Companies should review their working capital position quarterly or even monthly to make informed decisions.

4. What role does working capital play in mergers and acquisitions?

Working capital plays a crucial role in mergers and acquisitions, as it reflects the target company’s operational efficiency and financial health.

5. How can a business raise additional working capital?

Businesses can raise additional working capital through various means, such as equity financing, bank loans, or issuing bonds leading to the growth of the company.

6. Does working capital impact long-term financial planning?

Yes, working capital is connected with long-term financial planning. A stable working capital position ensures a company’s ability to sustain itself in the future and will also lead to growth opportunities.

CATEGORIES