IMPLIED VOLATILITY – THE GAME CHANGER FOR OPTIONS PREMIUM

If I say “Change in implied volatility can have a greater impact on an option’s premium than the effects of delta, gamma, theta and rho combined” Sounds surprising?

But it’s true.

Have you noticed some time we pay too much premium for an options and sometime we get the same option with same strike considering same time left in expiry but still option’s premium is low, this is just because of volatility.

You may hear financial talking heads say, “Volatility is high, so the market is going to bounce or the volatility is low, hence the market is due for a sell-off”. Many might say that volatility sets where the market is going and bends its direction. However, volatility doesn’t change the direction of the market, rather helps a trader opt the suitable and perfect trading strategy. There is also a saying that “change “in IV can have a more significant impact on option’s premium than options “Greeks”. But how?

Lost in the financial textbooks for years, the term “Volatility” has always been a crucial tool when it comes to trading, especially for options trading. There are several secrets of trading hidden within this crazy, old concept of IV that can change the way you see the options trading. Let’s dive deeper in this concept:

Table of Contents

ToggleWhat is Volatility

Volatility is often referred to as the heartbeat of the financial world. It helps measure how quickly share prices fluctuate. Some people interpret a bearish trend as the “volatility” of the market, but in reality, it isn’t just about falling; it represents constant ups and downs in the market.

- When stocks quickly go up and down a lot, people call them high-volatility stocks.

- On the other hand, if stock prices don’t change much or stay pretty steady, they’re known as low-volatility stocks.

There are typically two types of volatility in the finance world i.e.;

- Historical Volatility: Study past price movements of an asset to assess its historical risk and behavior. Simply put – it’s how much the price has fluctuated on a regular basis over one year.

Implied Volatility: Implied volatility isn’t basically about historical pricing data on the stock. Despite what the stock market “implies” the volatility of the stock will be in the future, as per the change in option price.

What is Implied Volatility (IV)?

Often abbreviated as IV, implied volatility, is a finance concept used in the world of options and stocks. It is like a mood indicator for the market, showing if traders are calm or in panic mode. When panic rises, IV goes up, making options more expensive. In calm times, IV drops, and options become more affordable.

Implied Volatility (IV) isn’t a guaranteed thing, but it’s useful for traders to decode statistical ranges, aiding in risk management and buying power considerations.

Some traders mistakenly assume that volatility is based on the stock price’s directions. Not really! It simply considers the amount of stock price fluctuations, based on the market sentiment, without regards for direction.

- High IV = Expensive option premiums, due to increased panic. Traders expect big price movements.

- Low IV = Cheaper option premiums, as the market remains calm, hence no significant change in option price.

One thing to keep in mind: implied volatility is all about market sentiment and predictions – it doesn’t care about the nitty-gritty details of a company.

Key Takeaways:

- Implied Volatility helps traders read market moods, guiding them on whether it’s a good time to buy stocks.

- IV responds to news and events, shaking up market sentiments and impacting options prices.

- IV doesn’t steer stock price direction, but it’s your buddy in assessing how risky or cool trading in the market might be.

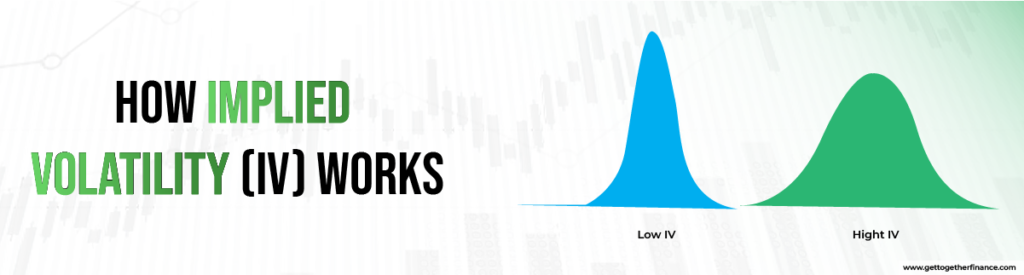

How Implied Volatility (IV) Works

Derived from the option contract prices, Implied Volatility (IV) is a measure, which is mostly used for options. It helps calculate the potential price fluctuation in the future.

Based on different truths and lies in the marketplace, options prices will begin to change. If there is a budget announcement or a major court decision coming up, a shift in the trading patterns of options traders can be observed.

For an example, let’s say you’re considering two options on the same stock that have the same strike price and expiration date. Option A has a higher IV, while Option B has a lower IV.

Option A (High IV): When IV is high, the market expects big price swings due to more panic caused by major events. This results in a pricier Option A. More active traders are in the game, leading to significant price moves.

Although it doesn’t control the stock value or direction, traders foresee larger price shifts in either direction. Trading during high IV is often not recommended due to the increased uncertainty.

Option B (Low IV): In low IV, the market anticipates minimal price swings due to a more calm scenario. This is often a result of reduced panic caused by fewer major events. It results in a lower premium for Option B. Trading during low IV is generally considered more favorable.

Implied Volatility and Options

Majorly there are three factors used to set the options pricing. Implied volatility is one of them. Think of implied volatility as a flexible number that changes as the options market gets busier.

Generally, when IV goes up, the price of options also goes up, assuming everything else stays the same. Hence, if implied volatility rises after you’ve made a trade, it’s a good sign if you own the option. But if there is panic, there is an increased number of active traders, then the market will re-settle itself too.

On the flip side, if IV goes down after your trade, the market stays constant with surreal value, hence option prices usually drop. This is good news if you sell the option, but not if you just bought it.

Remember, IV is like an educated guess made based on probability. It’s not an exact prediction of where prices will go, but helps traders understand the mood swings of the market. Investors use it to make decisions, but it doesn’t guarantee that option prices will follow the expected pattern.

Also Read: Volatility Index

Options Pricing Models

Implied volatility (IV) is a very crucial element in option pricing, yet it’s the one factor you can’t simply observe in the market.

To set the fair value of options, the pricing models are used by traders/investors. It helps them understand how much an option should cost based on several factors. Firstly, let’s discuss some of the popular and commonly used option pricing models including:

- Black-Scholes Model

- Binomial Model

- Cox-Ross-Rubinstein Model

- Trinomial Model

- Bjerksund-Stensland Model

- Barone-Adesi and Whaley Model

- Merton Model

- Jump-Diffusion Models

Theoretical parts are hard to learn and complex to understand. There is another pricing model technique, used by experts and is way to practical. As this is evident that options are priced because of the scrip price and crowd expectations.

There are two values of options pricing, to be added together for the total pricing value of options:

Premium = Intrinsic value + Time Value

Or

Time Value = Premium – Intrinsic value

Let’s take an example to understand this:

- Stock Price: ₹580

- Strike Price: ₹550

- Call Premium : ₹22

Calculate Intrinsic Value:

Intrinsic Value = Stock Price – Strike Price

Intrinsic Value = ₹580−₹550=₹30

Calculate Time Value:

Time Value = Call Premium−Intrinsic Value

Time Value = ₹ 22 − ₹ 30 = − ₹ 8

In the above example, intrinsic value depicts the actual value of options based on the stock price and strike price i.e. ₹30. However, the time value is negative (-8), showing that the premium of options is mainly affected by intrinsic value, with a potential time decay factor. The whole thing impacts its overall value, setting the options pricing standards.

These option pricing models are the magnifying glass that helps us uncover the elusive IV, essential for making informed decisions in the world of options trading.

VOLATILITY IMPACT

If Implied Volatility (IV) is low as compared to Historical Volatility (HV) then option are deflated.

As IV changes with dynamic crowd expectations (CALM-PANIC), the time value portion of the option premium inflates or deflates.

Let’s differentiate IV AND HV

| HISTORICAL VOLATILTY | IMPLIED VOLATILTY |

|---|---|

| Based on underlying | Based on Option price |

| Measurement of the speed in recent | Measurement of speed for future (EXPECTATION) |

| Measurement of speed for future (EXPECTATION) | |

| Respond to crowd psychology and can move to unreasonable extremes |

IV increases during News, Event, Quarterly Results, Corporate Action etc.

Pros and Cons of Using Implied Volatility (IV)

IV helps calculate the market sentiments to know the market movement size, but surely doesn’t tell the direction stories. Used by option writers to price options contracts, various investors consider it before investing in any asset. In case of higher IV, they prefer to go with more safer products or sectors.

Here major advantages and disadvantages of implied volatility:

| Advantages | Disadvantages |

| Provide insights of market sentiments and expectations. | Can be subjective based on trader’s sentiments. |

| Affect options pricing and help traders assess risks. | Highly sensitive, can change rapidly making it hard to predict. |

| Valuable tool for options strategies and risk management. | Predict movement but don’t predict the price direction. Result depends on personal biases. |

Implied Volatility Vs Realized Volatility

Implied volatility where anticipate potential market mood to interpret potential price movement of a stock in future, often used for options. Whereas realized volatility assess actual price fluctuations that happened in the past, scaling from historical price movement over a specific time. But wait! We have simplified the key distinction between implied volatility and realized volatility in the below table:

| Criteria | Implied Volatility | Realized Volatility |

| Definition | Anticipation of market truth or lies to interpret stock price movement. | Interpretation of actual price fluctuations that occurred. |

| Source | Derived from option prices and market demand. | Calculated from historical price movements. |

| Forward-Looking or Lagging | Forward-looking, predicting future movement for options. | Lagging, based on past price fluctuations. |

| Used in | Primarily used in options pricing. | Assesses past market volatility. |

| Influence on Trading | Can influence option buying and selling. | Reflects how much the market moved. |

The Traders Challenge:

Determining what is inflated and what is deflated?

Let’s take an example of balloon, suppose balloon is completely diffuse then we can say it is deflated and if start filling air in this it will start inflated, but at a certain point when the balloon completely filled with air and there are no more room for air then we can say it is super inflated and still if are we are trying to fill air, balloon will burst and start deflated.

Same with options, when people are in calm mode the volatility is deflated but when they come in panic mode volatility start increasing and may go to super inflated level. But at certain point it will start dropping when people will come again in calm mode after news or event then it will revert to the mean.

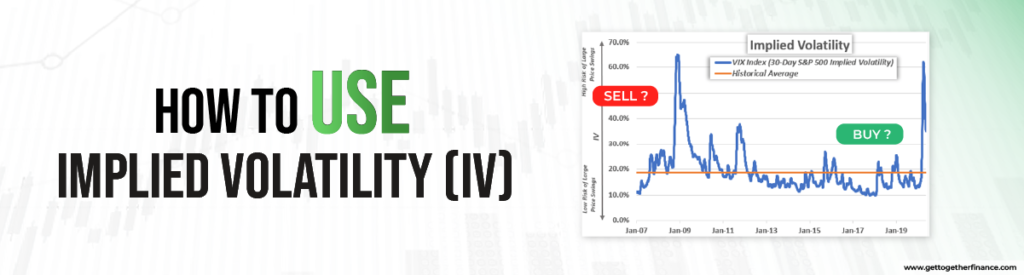

BUY -> DEFLATED OPTIONS

SELL -> INFLATED OPTIONS

How to Use Implied Volatility (IV)

Implied volatility helps investors figure out how risky a stock option is. Imagine two stock options: one with high implied volatility (IV) and another with low IV. The high IV options are like a roller coaster, more likely to surprise you, so you might invest less if you’re not a fan of big surprises. Expert traders recommend not buying options during the time of high IV. For options traders, a spike in IV could be a chance to sell options, like selling tickets when demand is high. If IV drops, it’s like a sale, so buying options might be a good idea.

IV is also optimized to hedge a cash position. For instance, if the current IV of your stock is relatively lower than IV of the whole year, you can buy those options at a low premium and watch it grow. When the IV goes up, the premium value increases, pushing the overall option value upward.

You can plan an option trade using IV. For example, if the option is trading with high volatility, you should avoid buying securities or sell securities as the market is fluctuating based on marketplace panic. As IV goes up, the option premium becomes more expensive, hence it is not a good buying choice and you can plan to sell. Implied volatility helps you determine which options’ value is more likely to go up so a trader can plan their entry/exit by calculating IV charts.

Vice versa, if the IV goes down, that’s a good sign that the market has gone to its constant. You can buy your options and watch it rise and flourish with time. These are ideal conditions to sell options and enjoy benefits with minimal risk of losing your money.

Factors Affecting Implied Volatility

The significant factors that affect the implied volatility are the market sentiments, news, corporate actions, fear, time of expiration, economic events, market liquidity, etc.

Implied volatility can change suddenly and is mainly influenced by the number of active traders or major events happening or affecting the stock marketplace.

When many people want an option, its price rises, and so does the implied volatility. This makes the option more expensive due to the added risk.

Conversely, if there are plenty of available options but few buyers, implied volatility decreases, and the option becomes cheaper.

The time remaining until the option’s expiration also plays a role. Short-term options typically have lower implied volatility, while long-term ones tend to have higher implied volatility. This difference is related to the amount of time available for the price to potentially move in a favorable direction compared to the strike price.

INFLATED OPTIONS VS. DEFLATED OPTIONS

Options are priced based on the probability and expectations of price movement, therefore:

The higher the Implied Volatility, the higher the option’s premium for the same participation -> the higher the IV, the more inflated options: Options are expensive…And we love to sell them…

The lower the Implied Volatility, the lower the option’s premium for the same participation -> the lower the IV, the less inflated options: Options are cheap… And we love to buy them….

SUMMARY:-

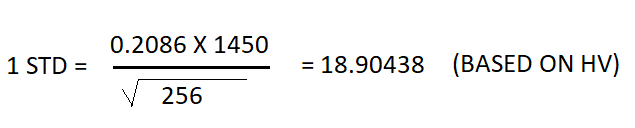

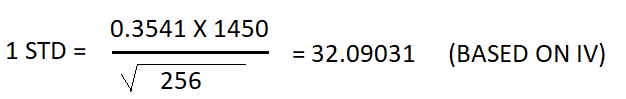

1 STD = ONE STANDARD DEVIATION (68% OF THE CASES)

As we all know this formula let’s take an example to understand this

Suppose Current Market Price of the Stock is 1450

HV IS 20.86 % AND IV IS 35.41% (in terms of %)

first of all need to convert it into terms of RS.

Based on the current HV the scrip has potential to move up or down Rs. 18.90 in a day, in 68 % of the cases (That would be a normal things to happen)

Based on the current Implied Volatility the scrip is expected to move up or down Rs. 32.09 in 1 day, in 68% of the cases (That would be a normal things to happen)

Implied Volatility Determines Strategy

IS IMPLIED VOLATILTY HIGH OR LOW?

The answer will determine which options strategy to use

| CONDITION | LOW IMPLIED VOLATILITY | HIGH IMPLIED VOLATILITY |

|---|---|---|

| If we are Bullish | We should net buyer of call options(Debit Strategies) | We should net seller of put options (Credit Strategies) |

| If we are Bearish | We should net buyer of put options (Debit Strategies) | We should net seller of call options (Credit Strategies) |

FAQ

Q. What’s implied volatility?

Implied volatility tells the story of market sentiments – whether there is calm or panic among active traders. On the basis of that, options pricing varies. For example – if IV is high, that means there are more active traders, hence the options are more expensive. On the flip side, if IV is low, that means traders are calmer and the market is steady so is the option price.

Q. Why is Implied volatility important?

Implied Volatility is super crucial and is based on a trader’s psychology (panic/calm). It is significant for options traders as it helps understand market sentiment and potential movement anticipation. If IV is high, options might become expensive. On the other hand, if IV is low, they are cheaper comparatively. It’s a big deal for pricing options and understanding the risks involved.

Q. Is high implied volatility good or bad?

As expert traders suggest not to trade during the high IV of the market, but some beg to differ and find opportunity in risk. According to expert traders, high implied volatility is mostly good for people selling options. But for those buying options, it can be tough because entering trades becomes pricier, making it harder to get good results.

Q. What is a low implied volatility range?

Range of low IV depends on the stock options. To analyze the low IV range, it is crucial to review the historical volatility of options of specific stock or indices. The indicator shows the high and low range of IV. Compare the current IV with the historical volatility. If the IV is substantially lower than the historical volatility, it suggests a potential low IV period.

Q. How is implied volatility computed?

Calculating IV is a bit tricky. It involves looking at how much people are paying for options in the market. Traders and fancy math models work on this to figure out what the market thinks about potential price changes.

Q. How do changes in implied volatility affect options pricing?

When implied volatility rises, options become more expensive because people expect bigger price changes. If implied volatility drops, options can become cheaper because there’s less anticipation of significant market moves. IV directly influences the cost of options and how risky they are.

Q. What is the difference between implied volatility (IV) and historical volatility (HV)?

IV helps calculate expectations of the market’s future price changes. While HV gauges historical price fluctuations. It can be said that IV is forward-looking, while HV is backward-looking.

Q. Can options be used for hedging against market volatility?

Yes, options are often used to protect against market changes. For example, buying put options can help prevent big losses in your investments, especially when the market is unpredictable.

Q. How do I choose the right options strategy based on implied volatility?

Select your options strategy based on what you think will happen in the market. If you expect significant changes, traders can opt for strategies like straddle. For calmer times, techniques like covered calls might be better.

Q. How can I predict implied volatility?

Guessing implied volatility isn’t easy. But looking at past volatility and upcoming events can give traders some ideas/clues. Traders watch historical trends and news to make their best guess on market mood and potential movement in the future.

Q. What does implied volatility measure?

Implied volatility measures active traders and market moods, especially in a specific period. This also shows how uncertain and risky the market feels at the specific time and how active traders are reacting in response to market uncertainty.

Q. How does implied volatility affect options prices?

Higher implied volatility tends to inflate option prices. It shows increased uncertainty and potential for larger price movements. Conversely, lower IV represents lower option premiums.

Q. What is considered a low implied volatility?

Typically, anything below 20 is seen as low IV. This shows that the market is expecting lesser ups and downs. It also indicates lower perceived risk and more predictable price movements in the short term.

Q. What is implied volatility in stocks?

Implied volatility tells the story of the market mood and behavior of active traders. It is one of the crucial aspects of options trading. If IV of an option goes up, it causes a rise in the option price. On the flip side, if the IV drops, options become more affordable.

Q. Is implied volatility beneficial?

Yes, especially for active options traders. IV gives overall views of how the market looks, giving insights into potential market preferences and price differences. Using IV, traders can spot the right moment to enter the market and gain benefit, while managing their risks.

CATEGORIES

Facebook

Facebook Instagram

Instagram Youtube

Youtube