Intraday Trading vs. Positional (Delivery) Trading: What’s the Difference?

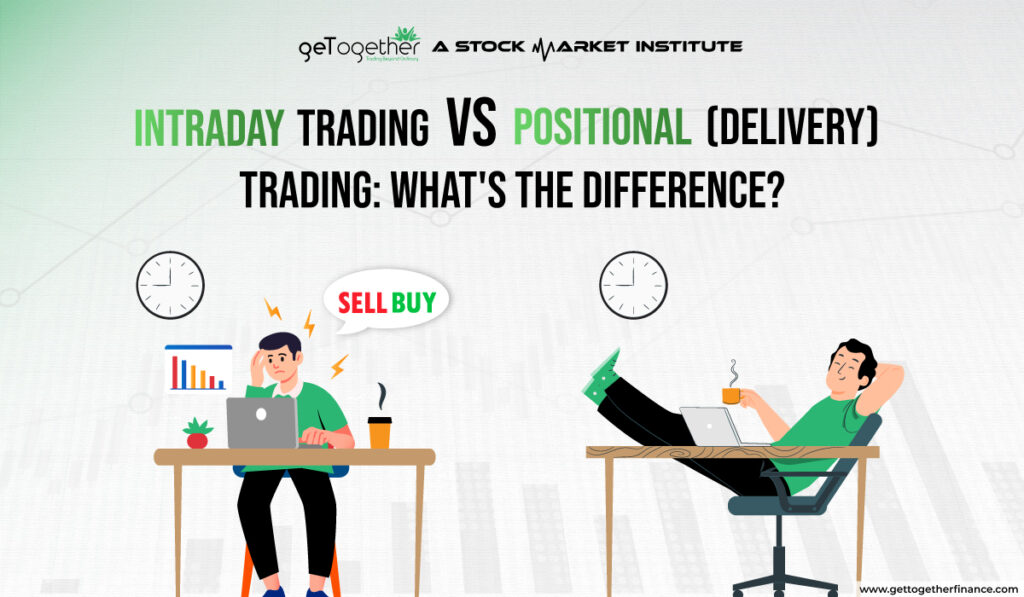

You’re new in the trading world and opened your application to buy some stocks. You see there are two options – intraday or positional (delivery)! And now you think, no one has ever told you the difference between intraday trading and positional trading.

Yes! It’s not the same – but can be similar. However, you need to know what is the primary difference, what does it mean, and how do they impact your investment journey? Let discuss those difference in detail:

Intraday Trading: The Rollercoaster Ride

Technically, ‘intra’ is a Latin word that means ‘within’ a single group, time, or place. As the word explains itself, intraday trading is buying and selling listed securities but on the same day. Think of it like a rollercoaster ride at an amusement park where you can have a lot of fun but only for a limited period of time. So let’s break it and see how it works:

Buy and Sell in a Flash

Imagine you’re at a busy marketplace, and you spot a vendor selling fresh fruit. And then you buy a basket of apples in the morning with the hope that the price might go up by noon. And guess what? It does! So, you sell those apples at a profit.

No Long-Term Commitment

And the catch is, you don’t actually own those apples. You just put a bet on whether the price will go up or down. Just like predicting the weather for a few hours, but not planning for the whole season. And there you’re – in and out of the market in just a matter of time.

Thrills and Chills

Well! The most fun about intraday trading is that it can be thrilling, but sometimes in a scary way. You see quick profits, but it’s not all rainbows and unicorns. The market is volatile and risky, like that rollercoaster ride. You might feel on top of the world one moment and queasy the next. Prices can swing wildly, and you need nerves of steel.

Positional Trading (Delivery Trading): The Slow and Steady Approach

Positional trading (delivery trading) is more like planting a tree in your backyard. You buy stocks to keep them for the long haul in expectation of potential higher return. Here’s how it works:

Long-Term Investment

Think of buying stocks as planting seeds. You water them, nurture them, and patiently wait for them to grow into sturdy trees. Similarly, when you indulge in long-term investment, you select your stocks carefully with a long-term commitment to reap the maximum benefit. And the growth is not a quick fix, but steady.

Real Stock Ownership

Unlike intraday trading where you constantly buy and sell stocks throughout the day, in positional trading you really own the stocks, just like having a pet. If you own one, you get the ownership of shares and the company (however every company complies with different policies of shareholder indulgence in company’s matters). You can also hold onto these stocks for weeks, months, or even years. Simply put, it is not just a quick trade; you’re invested in the company’s success for the long haul.

Less Tension & Higher Potential Return

The thing about positional trading (delivery trading) is it might not give you the adrenaline rush of intraday, this is a stable and long-term game. Like a slow and steady turtle, and as the story goes, the turtle wins the race in the end.

Intraday Trading vs. Positional (Delivery) Trading: The Difference?

The major distinction between intraday and positional trading lies in the time horizon and investment approach of individual traders. Intraday traders focus on short-term price swings within a single trading day. Traders make shifts and frequent entry and exit to capture a small chunk of profit throughout the day. On the other side, positional traders believe in longer-term investments, holding positions for weeks, months, or even years. Traders mainly net-pick companies with strong fundamentals with a good potential to grow in the long run.

Intraday traders require a high level of discipline, focus, strong trader psychology, and quick decision-making abilities. On the flip side, positional trading demands patience and a long-term perspective. Traders need to be more comfortable with market volatility and price fluctuations to prevent impulsive decisions based on short-term market noise.

Let’s get to know some of those classification in brief to get a more simplified view:

| Aspect | Intraday Trading | Positional Trading (Delivery Trading) |

| Time Horizon | Short-term (same trading day) | Long-term (weeks, months, or years) |

| Ownership of Stocks | No actual ownership; betting on price | Actual ownership of stocks |

| Profit Duration | Quick, intraday profits | Gradual, long-term gains |

| Risk Level | High risk due to price volatility | Lower risk, stability |

| Trading Frequency | Frequent buying and selling | Less frequent buying and holding |

| Nerve Factor | Nerve-wracking and fast-paced | Steady and less emotionally taxing |

| Suitable for | Risk-tolerant, experienced traders | Patient, long-term investors |

Choose Your Trading Style Wisely

Intraday trading is like that quick thrill ride at the amusement park. It is exciting, quick, and can bring quick wins. But it is full of ups and downs, just like the rollercoaster ride.

Positional trading (delivery trading), on the other side, is more like growing a garden. This needs more patience and long-term perspectives with right trading psychology. Your investments may grow slowly yet steadily, like trees, but there will be no instant gratification.

In A Nutshell

So, which one would you choose? Well, this completely depends on your risk tolerance, investment goals, and how much excitement you can handle. Some traders love the adrenaline rush of intraday, while others prefer the stability of positional trading (delivery trading).

Remember, you can not pick any one-size-fits-all approach in the stock trading world. However, you can have in-depth knowledge of both and then decide what suits your style and objectives. Whether you’re a rollercoaster enthusiast or a patient gardener, the stock market has something for everyone.

FAQs

What’s the biggest difference between intraday and positional trading?

The major difference between positional and intraday trading lies in the time horizon. Intraday traders aim for short-term price movements within a single trading day and capitalize on quick ups and downs. Positional traders, on the other hand, dive deep in the depth, holding positions for weeks, months, or even years, to profit from a company’s overall growth.

What kind of analysis do I need for each trading style?

Intraday traders require heavy technical analysis, using charts and indicators to identify trading opportunities based on price patterns and momentum. Positional traders might also use technical analysis for entry and exit points, but they also emphasize fundamental analysis. This involves evaluating a company’s financial health, growth prospects, and industry trends to assess its long-term value.

Which requires more time and effort?

Intraday trading is more dynamic and volatile in nature based on demanding activity. Traders need to constantly monitor charts, make quick decisions, and handle the stress of potential losses. Positional trading requires patience and a long-term perspective. While research is needed upfront, traders don’t need to be glued to the screen all day.

Do I need a lot of money to start?

Intraday trading doesn’t necessarily require a huge initial investment, but frequent trading can lead to higher commission fees. Leverage (borrowing money to invest) can be used by experienced traders, but it comes with significant risk. Positional trading can be suitable for investors with a larger capital base as positions are held for longer. Leverage is generally not recommended for long-term holdings.

Do I own the stock in intraday and positional trading?

In most cases, intraday traders don’t take delivery of the physical stock (ownership certificate). They focus on buying and selling contracts to profit from price movements. Positional traders often take delivery of the underlying stock, becoming shareholders in the company. This allows them to benefit from potential price appreciation and dividend payouts.